D’latour – DK City @ Bandar Sunway

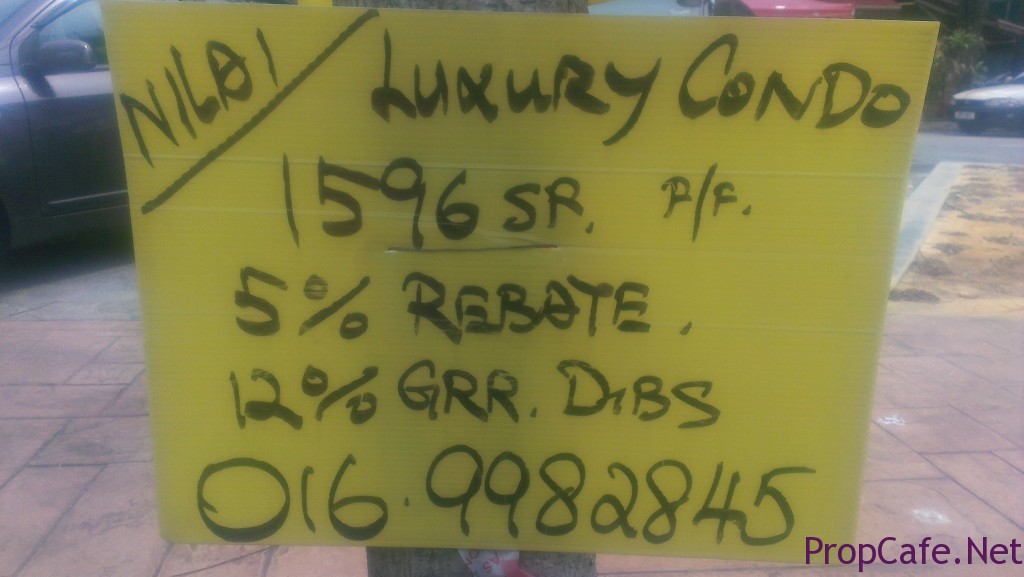

Ever been intrigued by ads such as these :

Or received SMS such as these :

Prestige Investment with 19.5% Rental Return for 3yrs. Duplex condo the 1st in Bdr Sunway near to Taylor & Monash University. Low & Installment down payment, 7% rebate, Free SPA & Loan Agr, DIBS, Fully Furnish & Advance Rental payment. An irresistible offer u can’t miss.

It was on the back of such SMS that I made the trip to view the preview of D’latour, by the DK Group.

From their company website :

DK Group of Companies comprises mainly of :

- DK Leather Corporation Bhd, holding company of the automotive leather upholstery group ( formerly listed on the Main Board of Bursa Malaysia Berhad in 2004 with a market capitalisation of RM 330.0 Million and was taken private in a cash GO in 2008 )

( Website : http://www.dk-schweizer.com/ )

- DK Leather Seats Sdn Bhd

- DK-Schweizer Europe B.V )

- DK-Schweizer (Thailand) Company Limited DK-Schweizer Middle East LLC ( installation and distribution in Dubai )

- DK-MY Properties Sdn Bhd

- DK-Land Construction Sdn Bhd ( construction arm)

- DK-Land Development (KL) Sdn Bhd

- DK-Land (Penang) Sdn Bhd

- DK-Land (Johor) Sdn Bhd

- DK-Land Property Management Sdn Bhd

At DK-MY, we strongly emphasize “Quality and Speedy Delivery” of products, coupled with a group of experienced and qualified professionals ; it is our motto to make sure all projects are managed effectively and efficiently.

DK-MY aim to offer products that meet the needs and expectations of consumers based on the latest lifestyle trends. At the same time, to always be in the forefront with innovations that set the standard for functional and value enhancing property products.

With 3 parcels of developments in the prime neighbourhood @ Bandar Sunway with a combined GDV of more than RM 2 Billion, the projects are located just a stone’s throw from the renowned and established Taylor University, at the vicinity of Sunway in Selangor.

As seen in the photo, D’latour is the second project in the whole of the DK City @ Bandar Sunway project : D’senza, D’latour and the soon the be launchd D’twist. As you might be aware, D’senza was launched 2 years go to not much fanfare, and yet it was fully sold out within months. That is a more dorm setting – strictly student housing. Whilst D’latour is a SOHO project, with a more upmarket feel.

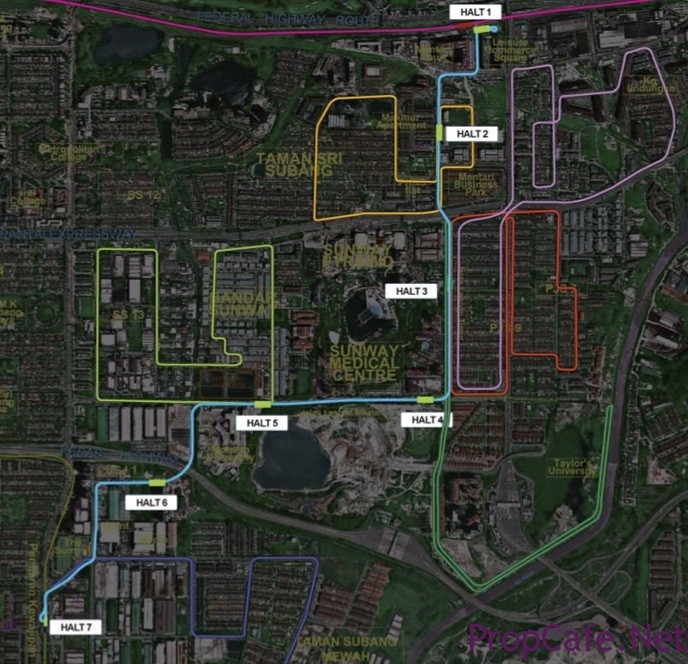

Location

DK City is located on the ‘other’ side of the LDP, specifically the location behind the LDP toll (behind the currently abandoned petrol station), bordered one one side by LDP, another side Taylors College and south side by Sungai Kelang.

Whilst to me, it is on the ‘poorer’ side of Bandar Sunway – it has the upcoming mall – D’Twist working in its favour, a new connectivity road – from Sunway GEO to here, in a loop; as well as feeder bus service provided by BRT – Connecting back to the BKT station.

D’Latour Features

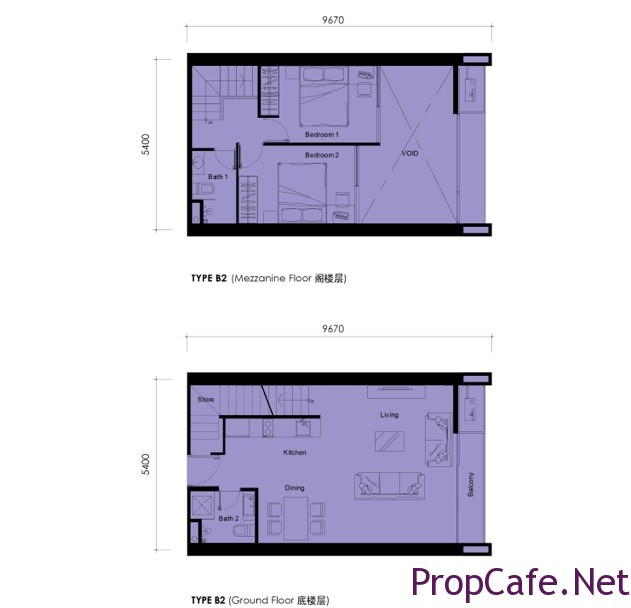

It is a 27-storey designer duplex tower, with a total of 629 units. Only units above 20th floors have 2 car parks, the rest of the units come with one car park.

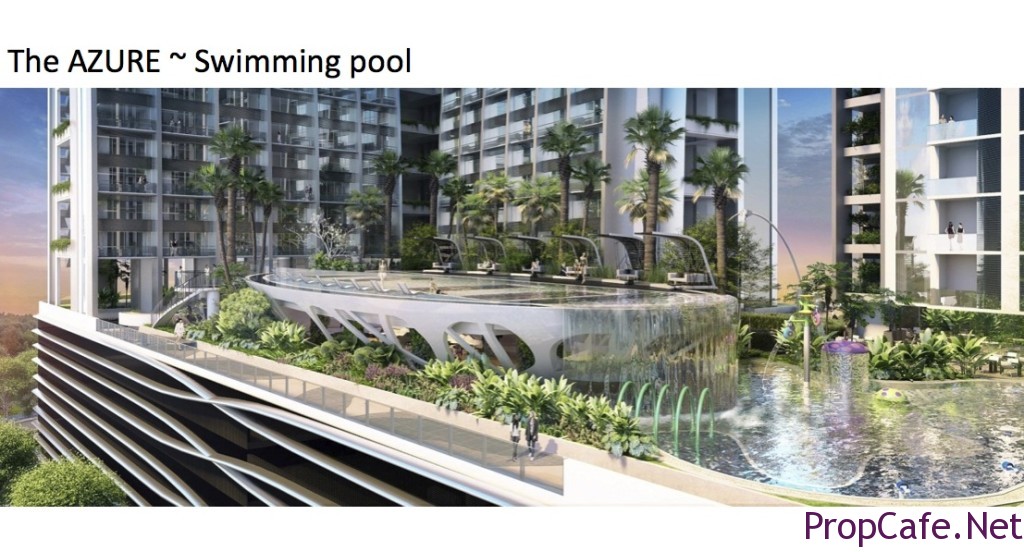

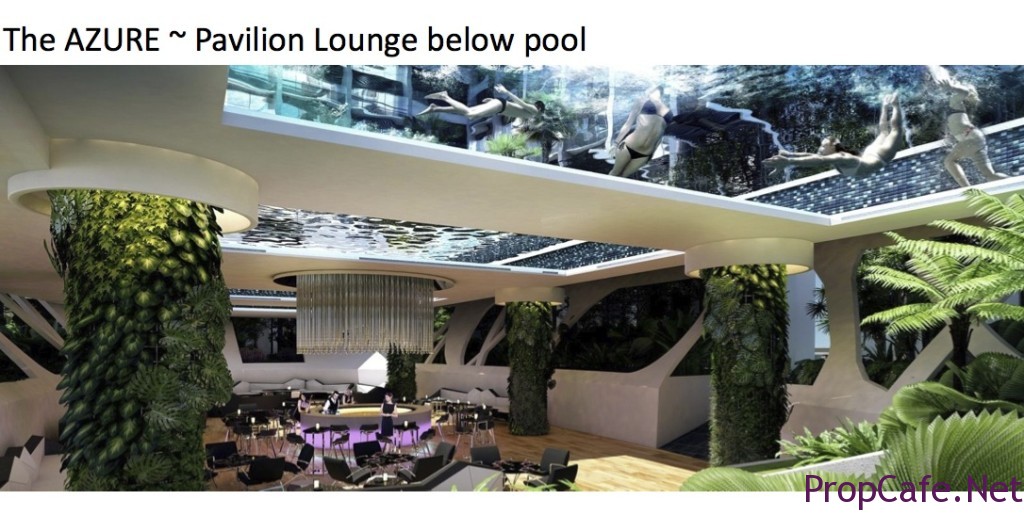

One of the signature features has to be the Azure swimming pool on the common floor (5th floor), as well as the Azure Lounge beneath the pool.

Since it’s quiet launch in March, the the up rate has been pretty good despite the selling price with over 50% taken up.

The current launch is the SOHO block on the left, the lower rise residential towers will be launched later this year.

Unique Selling Point

This is where it gets interesting.

The package comes with :

- Free SPA + Stamp Duty

- Free Loan Documentation + Stamp Duty

- Free MOT

- DIBS (0% interest during construction)

- GRR (Guarantee Rental return scheme) for 3 years

And of course, Part A of the attraction :

A total 19.6% GRR over 3 years, sure to be a sweetener to attract the ants to the honey. If you are able to come up with the downpayment, you can sleep for the the next 6 years knowing you will be getting the GRR for 3 years upon completion of the project.

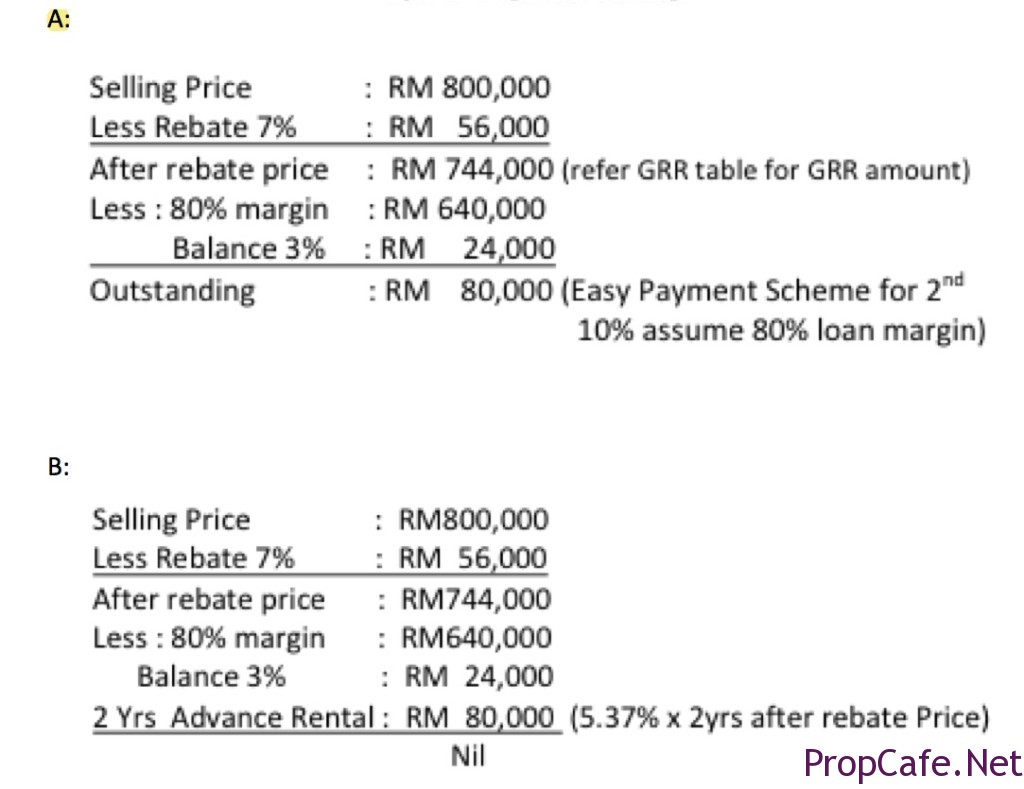

What about Part B : Advanced Guaranteed Rental Returns ?

Just in case you are worried about the developer not honouring their part in the GRR scheme, they are now willing to advance you the GRR, however instead of getting a GRR of 6.7%, you will only receive something like 5.3% But hey, there’s no free lunch and it’s money upfront!

You can use this bit, to either :

a) pay down the different between principal and loan, therefore taking a lower loan margin.

b) put in FD and earn interest

c) take and reinvest

d) use it to offset against the furnishing (required if you are opting for GRR)

Mandatory furnishing required amounts up to RM55k , and it basically fully furnishes your unit. Double bed, mattress, bed sheet, bed head, built in side table, desks, chairs, built in wardrobes for all the rooms, LCD TV, TV cabinet, lamp, air conditioner units, curtains, wall paper, kitchen cabinet, washer, and dryer.

Catch however is, with getting the money upfront – you will have no returns for 3 years upon VP in 3 years time. Totally dry. Any early selling of the unit before the end of the contract period will mean you have to settle the difference with the developer.

But with Advanced Rental , you actually can get up to 3 years of your GRR upfront, albeit at a slightly lower rate, slightly lower by about 1++%.

And with this Advanced Rental, you can choose to offset it against your next partial downpayment due, or use it to help offset fully furnish requirement (required to take, if you are settling for GRR) ; or if nothing, you can always put in good ‘od FD to earn interest upfront.

So cash needed upfront can be quite minimal, however, do bear in mind during the first 3 years after VP, if you’d opt for the Advanced Rental, you will need to fully pay up the bank loan each month, for up to 36 month – this would be the real test.

For me, this type A (2+1) is the ideal layout : 2+1 rooms. At RM830k, and LTV85% (yup, according to the kind developer, this is commercial titled and the panel of financiers are willing to finance up to LTV85% – this is a real boost for those of you who are capped by the LTV70 ruling). Even better, for certain financiers, if you purchase under company – you are able to get up to 90% financing! The developer has also kindly included pricing comparison with the neighbouring developments, projects in their sales kit.

By the way, to remind one of the SOHO origin of this project, take a look at the layout of type A :

One shows its function as an office, and the other – as a 2 bedder.

+

– unique proposition of advanced GRR, for those who are worried they might not be able to see the GRR returns, or delay in payments by developers etc

- unique project, with future service residents, mall and office tower coming up nearby

-

connectivity (feeder bus service to future BRT stops)

-

steady pool of tenants from nearby Sunway University as well as Taylors University (a more premium brand of students, vs Segi or Inti ? Highly debatable, but used as a selling point as well)

-

great for a real hands-off investment, can sleep at night with GRR

–

- ‘it ain’t cheap babe’ … at RM800psf, it is quite comparable to KL city area projects

– with future developments of Sunway Geo, Nadayu 28, Empire Remix all within the 3km radius, all targeting same catchment pool of students, i.e. rentals will be pressed beyond GRR period ?

- just because Sunway Geo is going to offer at RM1000psf doesn’t mean the project is cheap at RM800psf (even with GRR and fully furnished)

-

danger if cash flow is not managed properly, you will be stuck for 3 years with no income and monthly bleeding (of around RM3.5-4k depending on loan size)

-

will there be any catchment market beyond student market ?

-

access is a bane, loop around LDP toll – Sunway GEO : one of the most jammed toll plaza of the LDP, if not – the MOST jammed toll plaza along the whole of LDP

According to a little bird, however, surprisingly quite a number of the buyers have opted out of the GRR option, choosing to go with the project and rent out on their own with no mandatory furnishing requirements. Was also told, quite a few of the purchasers are actually parents of existing Taylors students (perhaps they understand the demand and potential for the project that we don’t).

Well decide on your own, it is quite an easy low entry project, but like everything out there – everything has been priced and the current pricing is reflective of that. Do your own homework and not be carried away by the easy money upfront. Managing the cash flow the next 3 subsequent years will be key. This is probably one of the more innovative financing scheme by any developer in the market today.

- take note, price for the available units have gone up since their initial viewing 3 weeks ago

Overpricing…and too many sohos…one issue is abt the BU stated in SPA…only GF’s BU will be stated in SPA…it might have issue when valuation during subsale

Sean, why do they do this? Are they hidding something that we dont know about?

If im not mistaken, only GF will stated in SPA for all the duplex soho…likewise empire subang, empire remix, etc….bcoz the approval by land office imho.

The total BU was stated in the SPA unlike other duplex unit..

Very balance review ! Nice work!

I actually see the real pain after the expiry of the 3 yrs GRR.

Take for example a 2-bedroom unit that cost 850,000 at selling price. After rebate of 7% you’re buying at 790,500.

Based on a commercial loan margin of 85% on the selling price, your mortgage loan will be 722,500. The down-payment will be 68,000 and with a current minus 2.4% BLR, 25-years max loan tenure, monthly repayment will be 3,890.

Having a GRR of 19.5% spread over 3 years means you will have an average yield of 6.5% per annum over your buying price of 790,500 means 51,382/yr or 4,281/mth.

What happens after 3 years guaranteed return expires?

Let’s say you would like to dispose the unit at a 30% capital gain at the end of the contract (6 years from SPA date) your selling price will be 1.13mil. Buyer’s loan repayment based on 25-years, 85% loan margin is 5,177.

In order for the new owner to maintain a 6% yield, he has to rent it out at 5,650/mth. Means 2,825per room (if you are targeting students).

Questions to ask yourself,

1) After 3 years of honey sipping, you get down to work on your own tenants. Who is your target market? Are you sure the management have all along rented it out at 4,280/mth?

2) If you wanna sell to investors at a 30% gain over 6 years, how to attract them to buy at a lower yield than 6%?

3) What are the market rates of other developments nearby and how many units will be ready for rent along with this development?

KL….Spot on!

Is it just me, or do I see a lot of creative financial engineering here. From my perspective the concept is quite similar to an infamous gold trading company recently isn’t it. And where do these high “rentals” come from? Well, from

the investors own pocket money of course! Mark up the product really high and subsequently give them back some rebates, guaranteed rentals, whatever you want to call it. Point is by the time the party ends, the investors are going to be stuck with an overpriced property with nobody insane to pay for the overpriced rentals!

Let me give you an extreme example, because honestly I am not too impressed with the guaranteed rental deal. Its all just financial engineering to me. Let me give you a deal. I have this fantastic low cost flat located in Shah Alam, next to a mosque and a fire brigade. I tell you what, if you buy from me I will give you a 30% guaranteed rental yield for the next 3 years (WOW!!! Really??!! Me: Yes, really). In fact, if you want, I can even give you an advanced rebate which you can set off against your downpayment. The price is 2 million ringgit for two bedroom flat, roughly about 2000 ringgit per sq foot. And it has got a local satay stall next to the car park. Have we got a deal? Call me if you are interested.

Seriously, there is one born every minute.

Greed will make you blind! This is the oldest but still working trick on human!

I am not the fan to invest prop with grr scheme or creative financial deals. Property investment needs to come with right borrowing and down payment capacity. Buyer must always know how much is your property worth. Thats jus very fundamental rules of prop investment.

Very good analysis. Honestly DK Group is not the expert in property development area, they can only produce low quality leather for Proton. Now they see properties are the lucrative business and this is why they jump in. BUT in business world, if you want to be the best, you must expert in your own field and don’t just follow the money. They should really learn from Bill Gates.

As the intelligent consumers, I think we better buy properties from those really expert developer like SP Setia and don’t be stupid to invest in this low quality properties as it is not cheap and just one mistake we might regret for our whole life.

Nobody can say good or wrong to invest on any property.too many expects here,a salute to all.to share the property experience ,not to give wrong information before giving comments

Actually if you check DK Leather business, they started with Proton leather, but now supply Maserati and Ferrari, GM in US, Volvo and Honda, and have facilities in US, Europe, ME, Thailand and Singapore! ….quite impressive. This SOHO looks very impressive compared to some of the others I’ve seen, SP and some other so called “expert” developer….. very well designed (hopefully implemented. My view of the “expert” developer is that all they are designing is the branding, the end product remains the same. Property investment is just another form of gambling, except “card readers” are not disallowed!