Investing Singapore Property The Walkthrough

After reading our earlier write up about steep entry barrier to Singapore Property, still feeling unfettered and you still adamant about investing Singapore Property.

Let us at PROPCAFE provide you some more investment pointers for your further consideration.

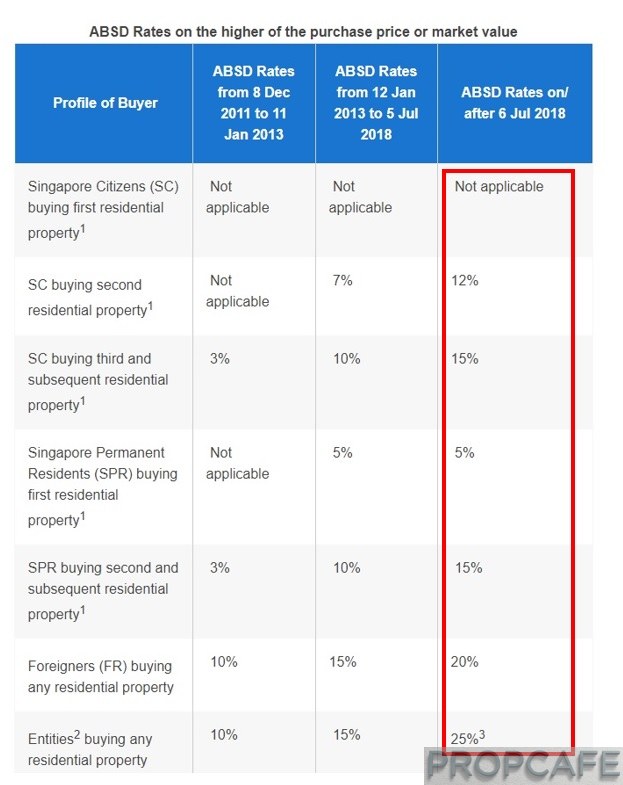

20% Additional Buyer Stamp Duty

If you are a foreigner in Singapore, let’s say you are a Malaysian you need to pay 20% on top of the SPA price or the property price.

We also would like to raise caution that even in the event that you manage to source for undervalue property reflected in SPA price, however for the assessment of stamp duty, Inland Revenue Authority of Singapore (IRAS) may levy the stamp duty based on market price (property valuation price). This would potentially be a hidden cost, we would strongly advise potential buyer to account for this accordingly.

The Singapore tax authority also closes off the loop against non individual buying Singapore Residential property, a flat 25% ABSD, if the buyer is other than individual.

ABSD on top of SPA price does it still make the investment viable?

Our take is that if we solely look at the price point it is NOT investible if the time horizon for the investment is of short term view, say 3-5 year. As the appreciation that you can get from property appreciation as been taxed up front. It is simply not logical to do so. Now remove the short term investment hat off.

However if you are looking for long term investment, diversification from Malaysian properties, why not.

Some push factors are:

A recent of downgraded by Fitch on Malaysia’s Long-Term Foreign-Currency Issuer Default Rating (IDR) to ‘BBB+’ from ‘A-‘.

Meanwhile Fitch rating for Singapore is at AAA.

Meanwhile we should remain optimist, it is also of no harm to have some back up plan set up.

Some take away from Fitch’s report are of

– Public Finances: A downward trend in general government debt/GDP, for instance due to implementation of a strong fiscal consolidation strategy after the pandemic recedes.

– Structural: An improvement in governance standards relative to peers, for instance through greater transparency and control of corruption.

Do you foresee improvement? Lets not get too stressed on this shall we.

Let’s put forth the assumption that ABSD factor can be mitigated as this problem typically can be overcome if we have significant savings.

Or there is a change of resident status from foreigner to permanent resident. Then our call will be upgraded to buy buy buy.

HDB or Private Condo, or Landed Properties

If you are permanent residents and fulfill the eligibility required HDB it is. But our take is not to treat it as an investment instrument after all the HDBs are primarily meant to resolve the housing needs of the local masses

What is HDB difference between HDB compare to a Private Condo

80% housing in Singapore are HDB or public housing while 20% are private housing (either apartment, condo or landed properties.

So can you compare a PPR flat vs HDB flat, yes you can.

Similarities:

- Looks generic, the older HDB flat do look almost the same.

- Built by government

However the newer built one, often not the same anymore. Newer ones are modernized.

Pinnacle@Duxton (below) is a SGD1mil HDB located right in the middle of Tanjong Pagar, part of CBD Central Business District in Singapore.

Skyville at Dawson (below) that is located in Queenstown, is also a newly built HDB that we think look like a condo at a very central location.

Perhaps you have this burning question in mind, so now PROPCAFE you are saving HDB looks same same like condo. Perhaps a certain extend if we evaluate it based on exterior look only.

However, there are some key differences, let us narrow down 3 key factors.

- Privacy and security

HDBs are accessible by general public while condo’s access is secured

- Neighborhood amenities

HDBs town are typically more convenient as it is surrounded by eateries, groceries shops

- Condo facilities

There is no in-house gym, footpath, sauna or private swimming pool for HDBs.

- Costs

If you buy directly from government, generally HDB starts from SGD100,000, to SGD700,000 depending on flat size and location, more mature HDB town will be slightly more expensive.

While condo, a studio will start from SGD600,000 to a couple of million, meanwhile landed properties will usually command about SGD2mil, depending on the size of land plot as well as the tenure of the land.

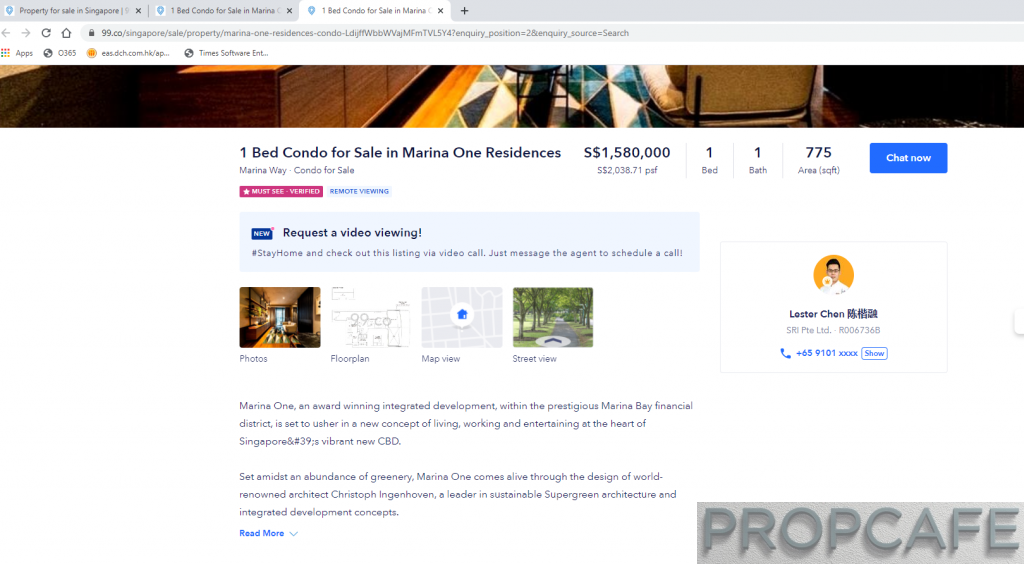

So now you have some knowledge on the Singapore housing market and would like to get your hands to one. Question, where to start? Go to online search portal.

There are 2 only search portals that are commonly used in Singapore, there are.

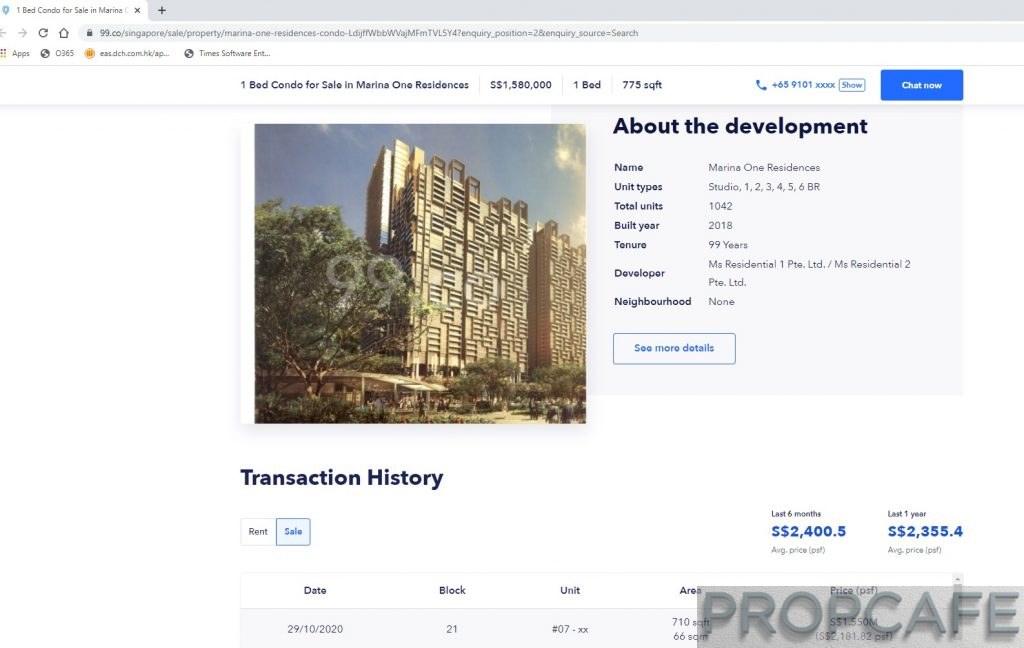

What we like about these 2 portals is that for past transaction prices, layout, are all shared transparently to ease buyer.

Transparent and Accessible Dousing Data

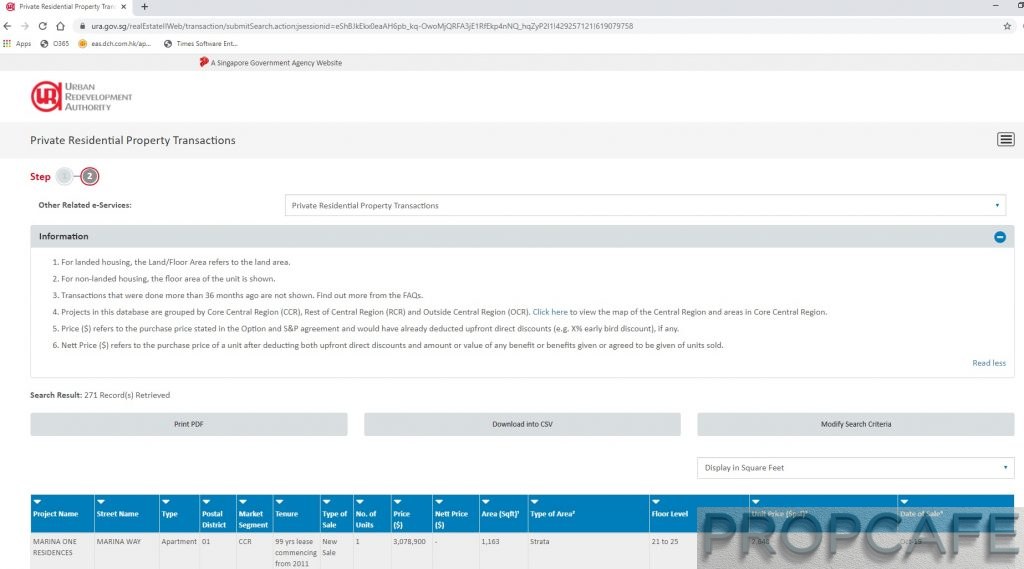

Singapore maintains very transparent on their housing market supplies, alternative you can check transacted price in Urban Redevelopment Authority (URA) website (www.ura.gov.sg).

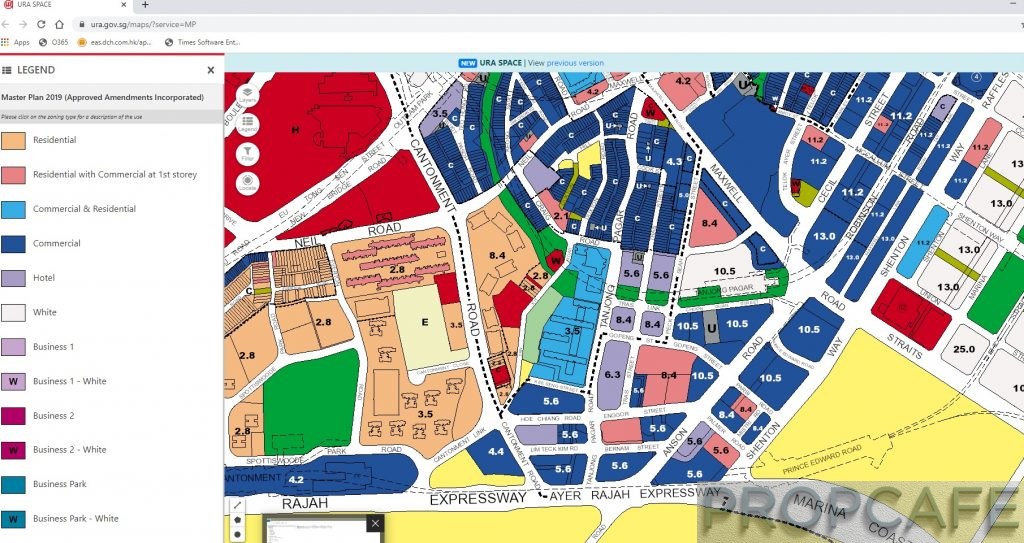

The Singapore development master are updated in URA website, the government state land sales is controlled and is released for development through the Government Land Sales (GLS) Programme through open public bidding.

The Master Plan is available for public viewing.

Singapore vs Malaysia Property worth to ay 3 times more, what about yield?

This writer thought that these are 2 different country, one to each own. Don’t compare too much, just accept that there are not the same, just to name a few, differing political landscape, education, the institutional trust and income level.

Malaysia will always be Bolehland, while Singapore will always be Majulah Singapura!

So you now you are ready and get some hold some serious cash to plonk down a deposit to BBB SG properties.

Let’s us walk you through the buying process shall we. investing Singapore property commences with the sign off of OTP, Option to Purchase.

In our opinion this OTP document is the most important document for the house purchase in Singapore. Make or break also depend on this document, we will share more with next write up for final piece of Singapore property purchase.

Hi My name is gary.

I am a real estate agent from Singapore.

I am looking for collaboration for malaysian property investors to buy condo in singapore.

I am also look for bloggers can help write articles for my website http://www.buycondo.sg to make it a successful website just like what you have done for propcafe.net. contact me via Wa.me/6594507545

[…] post PROPCAFE ™ Guide: Investing Singapore Home appeared first on PROPCAFE […]

I agree with the author that investing in Singapore property can be a good way to build wealth and generate passive income. The article does a good job of highlighting the key factors to consider when investing in Singapore property, such as the location, the type of property, and the cost.

Here are some additional thoughts on investing in Singapore property:

Do your research: Before you invest in any property, it is important to do your research and understand the market. This includes understanding the location, the type of property, and the cost.

Consider your investment goals: What are your investment goals? Are you looking to buy a property to live in, or are you looking to buy a property as an investment? Once you know your goals, you can start to narrow down your choices.

Get professional advice: If you are not sure how to invest in Singapore property, it is a good idea to get professional advice from a property agent or financial advisor. They can help you understand the market and make the best decision for your needs.

Investing in Singapore property can be a good way to build wealth and generate passive income. However, it is important to do your research and understand the risks involved before you make any investment decisions.

If you are looking for property investments in Singapore contact us at https://thecondo.sg/