Singapore Property Purchase Guide

Searching for the perfect Singapore property

We have earlier touched on our preferred property search portals that are www.99.co or www.propertyguru.com.sg. Property advertisements are typically advertised and paid by property agent. In this edition of Singapore Property Purchase Guide, we share more with you, first as to whether the property agent or the real estate agency is registered with the Singapore Council for Estate Agencies (CEA) you may check it here.

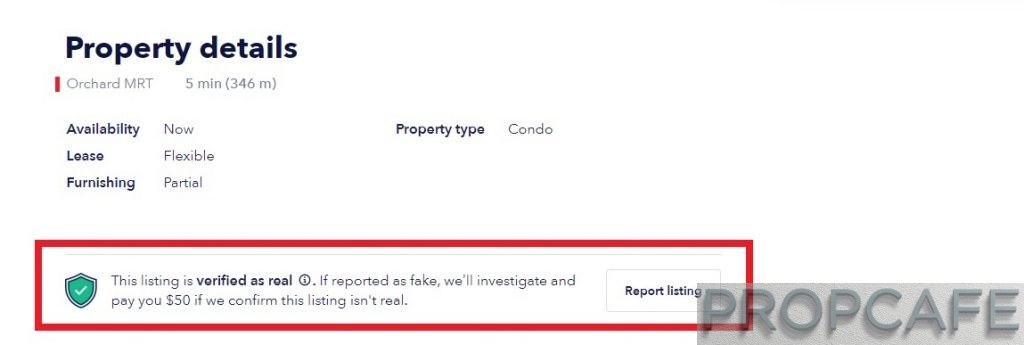

Avoid Fake Ads

Some portal such as 99.co actually got their ad verified and allow the consumer to report as to they are genuine or other. We think this is a quite a good feature, to evaluate if the ad or the deal is ‘legit.’

Our take on property agent, do your due diligence, interview and engage someone you are comfortable with and someone that is aligned to your interest. Most of the time, what you are seeing on the advertisement post in property portal as agent engaged by the owner, so it is not so hard to guess their interest is, that is yield best price for the owner. So engage another agent that is aligned to your interest may yield better result at least from the price negotiation point of view. As likely you may be presented with options, or other value add such as additional information to the unit you are interested in.

Our experience told us that the best deals are usually not found on the internet, good deals will come and go fast within a ‘circle’. A good agent will likely to share with you the best deal if he is in the circle. So how extensive network of the agent is also important.

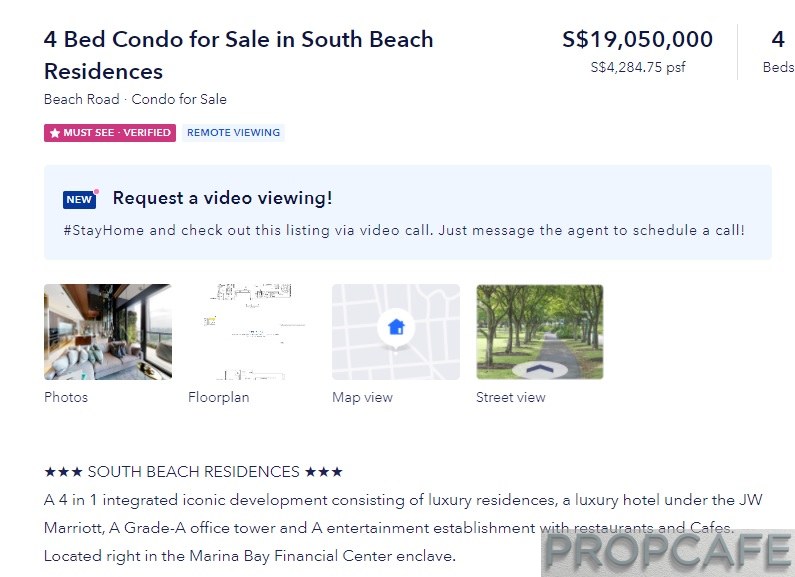

COVID-19 remote viewing, E-viewing

With the onset of COVID-19 pandemic, there are lots of remote viewing, e-viewing, 3D-view made available by property agents. For this writer, traditional view the actual house still preferred. Few fundamental reasons that we need to address.

First, if we will eventually stay in the house, for investment perhaps not so critical but still is not advisable to skip the actual viewing for resale/subsale properties. Not going to argue on the primary developer sales, as the most we can see are probably mock up sales flat.

Other benefits, include touch and senses the unit, noise pollution, smell, brightness, view. See it with your own-eyes. Other matters including the surrounding, the upkeep of the facilities, accessibility to the carpark, etc. There are also a saying, you are shown what ‘they’ want you to see.

DONE viewing

So you have gotten your cash ready, done your online viewing to your 100% satisfaction, it is time to sign the dotted line eh…

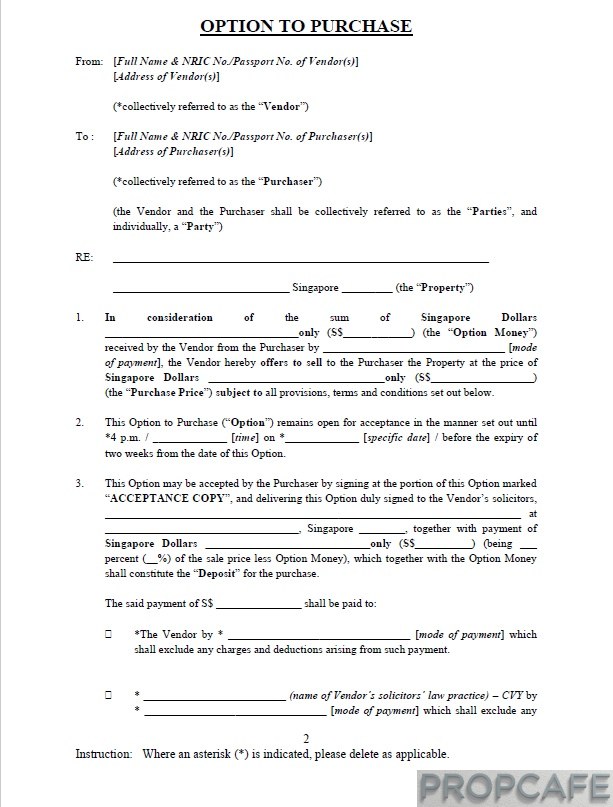

Hang in there before you do so, let’s go through this important document, OPT, Option to Purchase. This is no OTP ala Malaysia style. OTP in Singapore is an all serious document that you should be well versed off, as the implication is significant at least financial, or the timeline of completion (‘vacant possession”)

Disclaimer here: Not acting as a legal adviser.

The information, materials and opinions contained on this article are for general information purposes only, are not intended to constitute professional advice, and should not be relied on or treated as a substitute for specific advice relevant to particular circumstances.

Why so serious here:

Option to Purchase (OTP) is a legal agreement between the buyer and seller (or developer) for the sales of a residential property. When you sign the OTP agreement, you’ll need to pay an option fee to ‘reserve’ the property. If you ‘back out’ of the purchase – i.e. you do not exercise the option by the expiry date – you forfeit the amount paid.

That’s the major difference here for private property purchase.

|

Typical terms |

Malaysia OTP |

Singapore OTP |

|

Option fees |

3% |

1% |

|

Refundable |

Generally yes, if loan not approved |

Generally no, unless specifically both buyer and seller consent on refund of options fees for loan rejection |

|

Option period |

Generally 14 days (negotiable) |

Generally 14 days (up to 2 months) |

|

Option extendable |

Generally yes subject to agreement by both buyer and seller |

No. Reissues of OTP is longer allowed.*

|

Recently there is a clamp down on developer sales by the Singapore government, as usually sellers (developers) have the right to forfeit the option fee and put the property back up for sale when buyers do not exercise their option by the OTP expiry. However instead of forfeiting the option fees, developer then reissues a fresh OTP to the same buyer, making the OTP to appear as new. OTP shelf-life extension, cool right.

So with effective from 28 September 2020, this is no longer allowed. We understand that there are instances that developers could extend the OTP for up to 18 months.

top developers from re-issuing OTP to the same purchaser(s) for the same unit within 12 months after the expiry of the earlier OTP

This means that if you want to buy the property, you must exercise your option within the option period. However if you need time, you need to apply to the Urban Redevelopment Authority, maximum extension is up to 12 weeks from the OTP date.

https://www.ura.gov.sg/Corporate/Guidelines/Circulars/COH20-03

Come to think about it, buying properties in Malaysia is of lesser restrictions.

So how a OTP looks like vis a vis comparison. There you go.

After going looking through at these a headache or not. This writer also feels headache while putting these article up.

Get expert advice

We would advise the both purchasers and buyers to obtain professional legal advice on the drafting of OTP and as well as proper review of OTP ahead of signing off the dotted line.

Life is already so stress, let’s make our life easy by outsourcing those complicated matters to the professional shall we. After all the legal fees (typically SGD3-4k) is a small portion of incidental fees of the property price.

What else do you need in PROPCAFE Singapore Property Purchase Guide

So we have covered pretty much the all the key areas in this Singapore Property Purchase Guide. do let us know you want us to do more.

nice post