Propcafe recently came across an interesting piece of work from Cimb Research regarding Iskandar development. It has all you need to know about this futuristic city. Our blog is unable to upload the whole file due to its PDF format (and it is more than 200 pages), therefore, we extracted some of the valuable information here to share. Although it focus on Iskandar, it has also covers a lot of detail on Malaysia property market. Propcafe hope our readers will enjoy it. Again, full credit to CIMB Research. Execellent information! Thanks CIMB Research!

Excitement about Iskandar is reaching levels never seen before in Malaysia. This is understandable given that the “Shenzhen of Malaysia” reached tipping point last year. We remain bullish on the growth corridor and advise investors to position for the longer term.

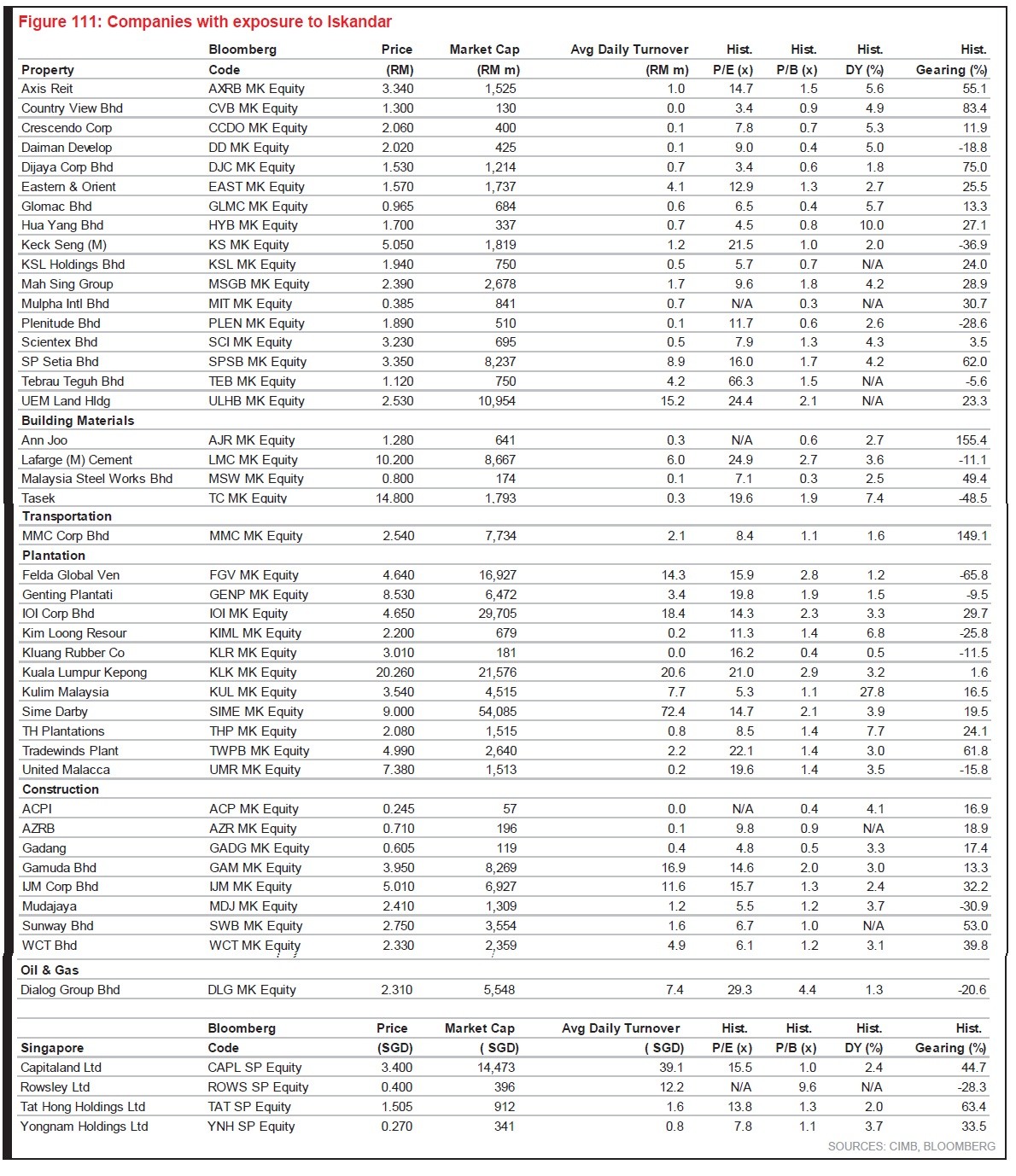

In this report we analyse Iskandar not merely from the typical property angle but also measure its progress economically and identify other sectors that will benefit directly or indirectly from proximity to the development corridor. Also, we look at Iskandar from the Singapore perspective as their buy-in is critical for its success. For exposure to Iskandar, our top choices include UEM Land, WCT and CapitaLand.

Why the sudden interest?

The Iskandar Malaysia development corridor has been long in the making and can in fact trace its roots to Renong and its Prolink 2020 project in the 1990s. But it was the completion of LegoLand, Puteri Harbour Family Theme Park and several education institutions in 2012 that woke up developers and property buyers on both sides of the Causeway to its huge potential. The recent meetings between the prime ministers of the two countries and the go ahead for the RM30bn high-speed rail project have cemented Iskandar’s position as the Shenzhen of Malaysia. Since Oct last year, Singapore investors have taken the plunge and invested in four multi-billion ringgit projects in Iskandar.

How best to play Iskandar?

Thus far it is the property and construction companies that have benefitted the most from Iskandar. The best proxy has always been UEM Land due to its huge landbank in Nusajaya and the fact that it is the flagship development arm of Khazanah Holdings, the key planner and driver for Iskandar. But there are other winners from the corridor’s lift-off, including building material companies given the construction boom, plantation companies with vast landbank in Johor, oil & gas companies on the back of two massive projects in Pengerang as well as Singapore developers and contractors that are making a beeline to Johor and Iskandar.

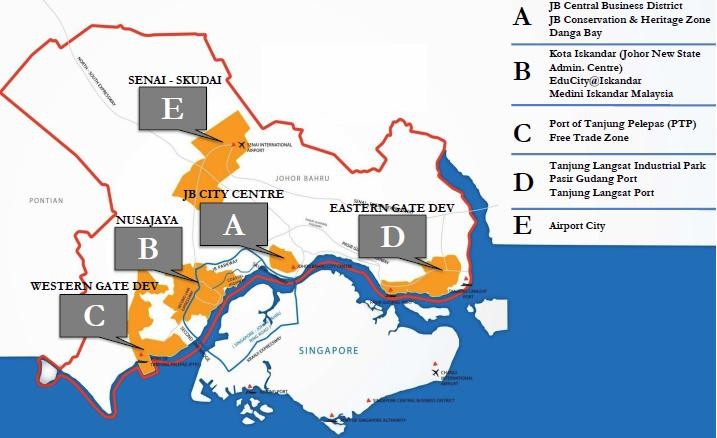

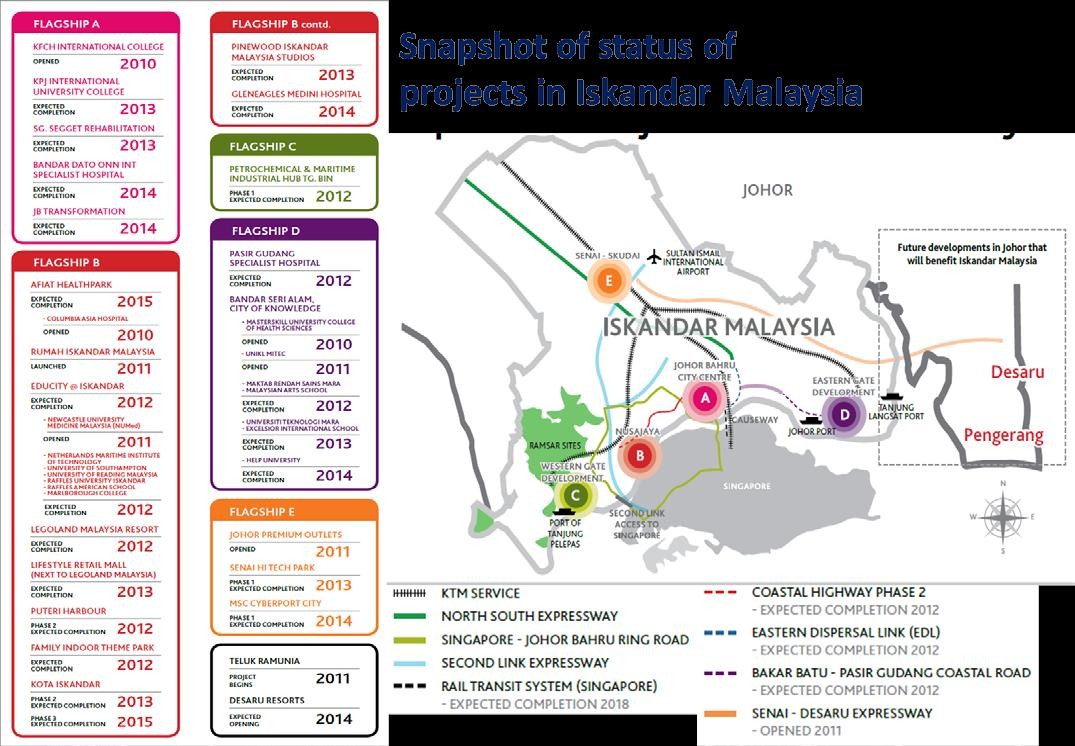

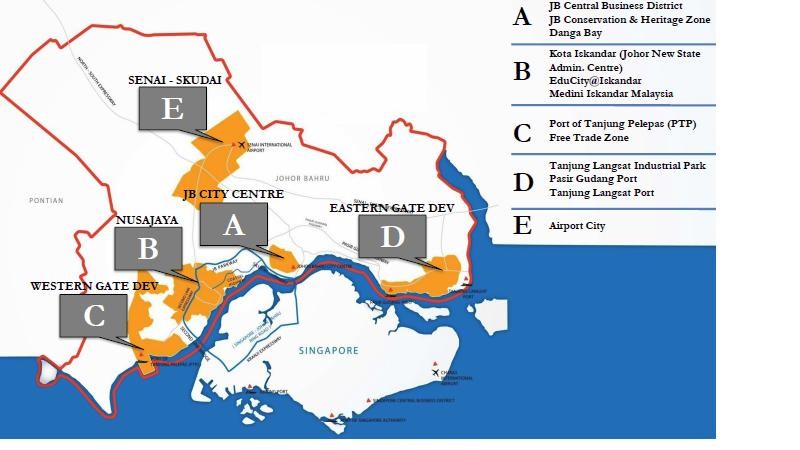

Five flagship zones in Iskandar

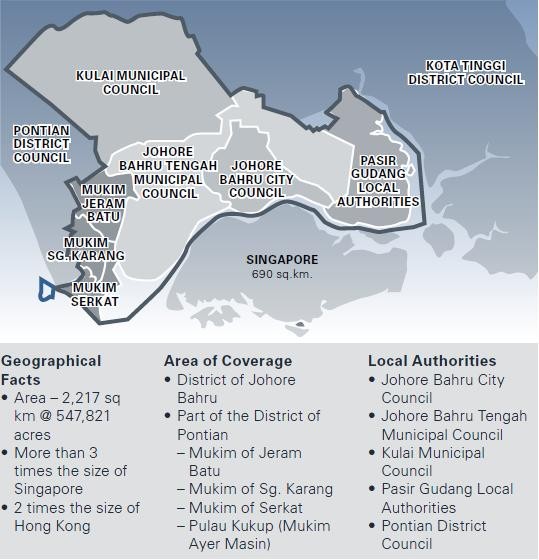

Iskandar Malaysia measures 2,217 sq km (547,669 acres) in total and aspires to be a self-contained, sustainable metropolis of international standing. It is three times the size of Singapore and twice that of Hong Kong. There are five flagship zones in Iskandar, namely two that are focused on urban development (Zone A and B) and three that are transport- and logistics-related (Zone C, D and E).

Nusajaya the heart of Iskandar

We believe Nusajaya is the heart of Iskandar. Many of the catalysts projects in Iskandar – including Kota Iskandar, Puteri Harbour, Medini, EduCity, Pinewood Studios, LegoLand, Puteri Harbour Theme Park, Afiat Healthpark, etc – are all located in Nusajaya. UEM Land is the largest land owner in Nusajaya with over 7,000 acres that remain undeveloped.

Investments are ahead of targets

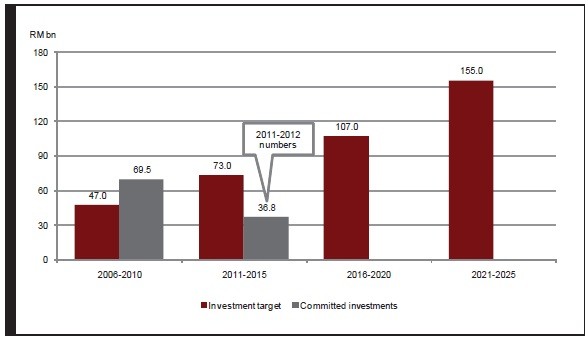

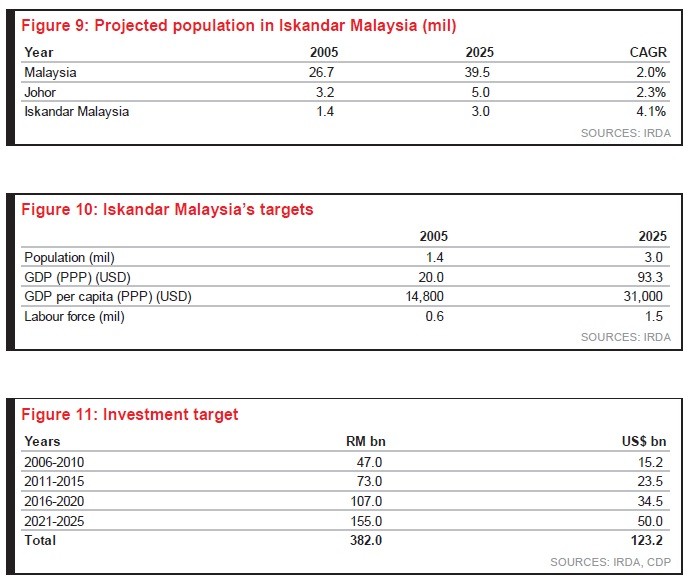

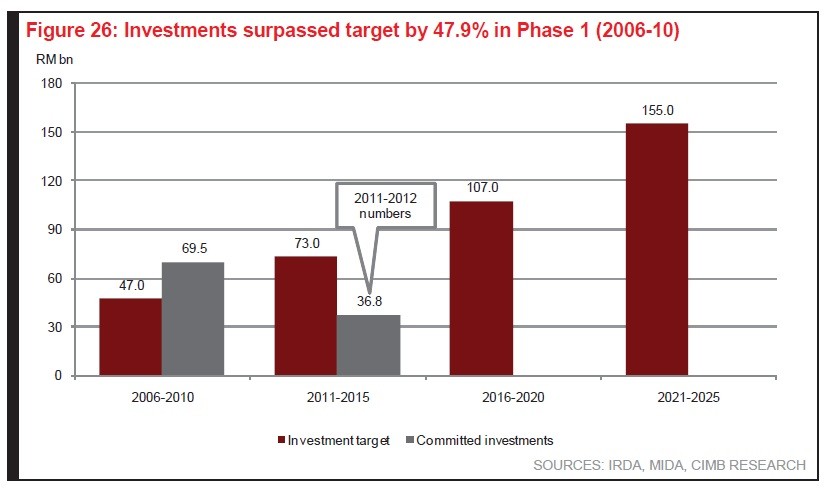

Since Iskandar was launched on 4 Nov 2006, its investment value has exceeded the Phase 1 (2006-2010) target by 47.9%. Total committed investments of RM36.8bn in 2011-12 already make up 50.4% of Phase 2’s target of RM73bn for 2011-15.

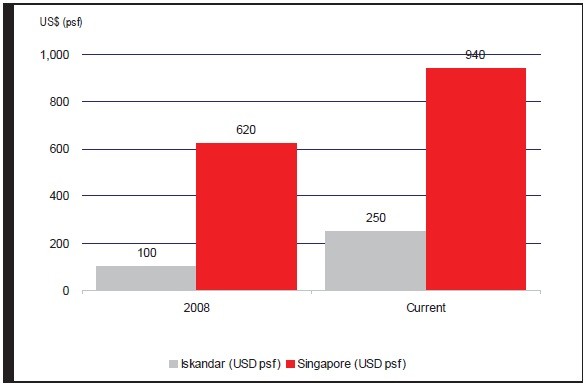

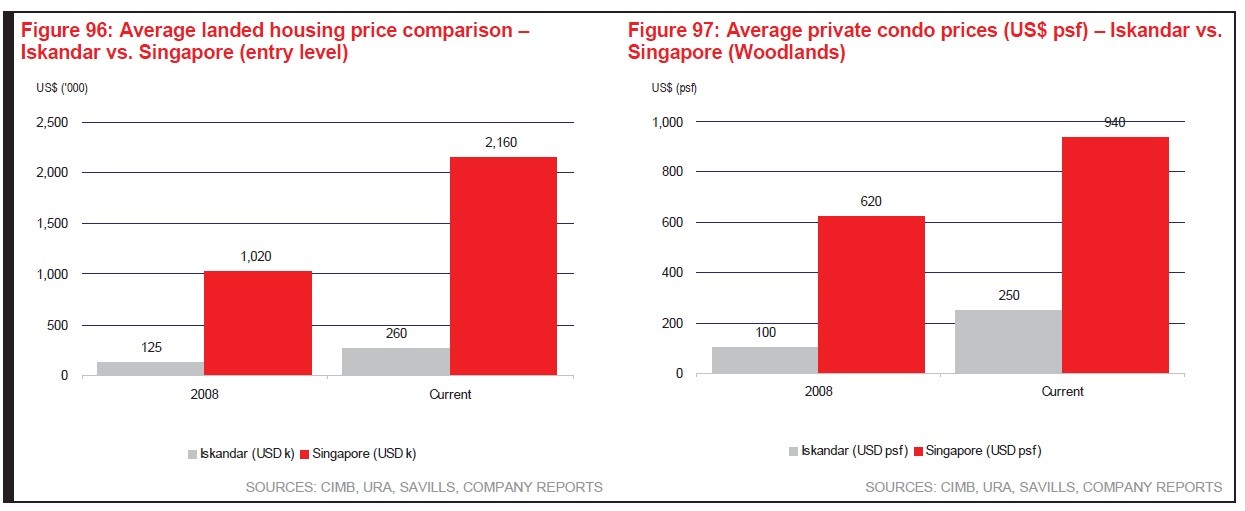

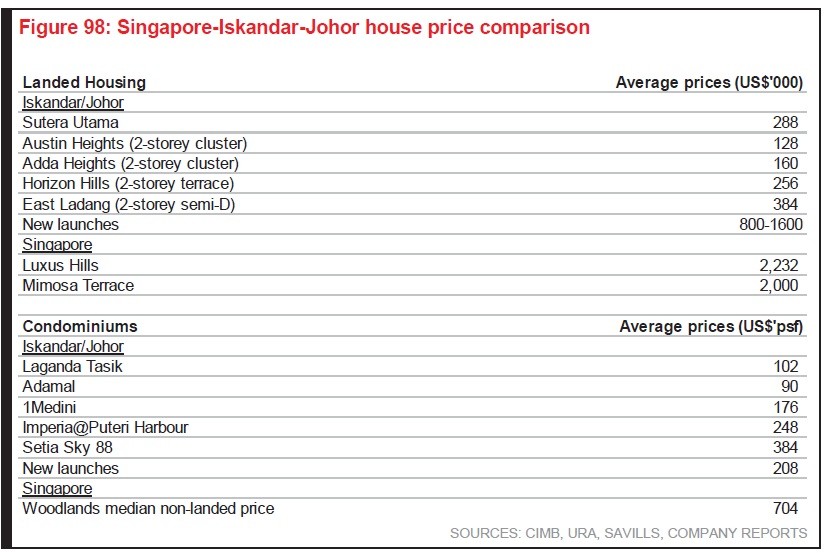

Condo prices in Iskandar vs. Singapore

The biggest attraction of Iskandar forproperty buyers is price. Singapore property prices are now above their historical highs (up c.45% from 2008), which has prompted the government to introduce stringent measures to curtail investment demand. While average prices at Iskandar have also more than doubled since 2008, current house prices remain 4-8x lower than that of Singapore.

1. WHY WE THINK ISKANDAR WILL SUCCEED

1.1 Bullish on Iskandar Malaysia

After many years of initial skepticism, we started to warm up to Iskandar six years back when we visited Johor for a 2-day tour and saw several major projects, such as Kota Iskandar and Puteri Harbour, beginning construction. We were also impressed by Danga Bay as developments there appeared more advanced than the catalyst projects in Nusajaya.

We turned bullish on the growth corridor 3-4 years back when even more projects, such as the Coastal Highway,

LegoLand, Puteri Harbour Theme Park/Traders Hotel and education institutions started ground work. We initiated coverage on UEM Land in 2011, by which time we had become a firm believer in Iskandar. We agreed with management that 2012 would be the tipping point year because, simply, LegoLand and the Puteri Harbour Theme Park would attract over a million visitors a year and Nusajaya/Iskandar would be far more visible to the world.

1.2 10 reasons Iskandar will succeed

If we had to summarise and quantify why we believe Iskandar will be a success, we would put it down to the following 10 factors:

1) It was planned by Khazanah Nasional, which has some of the best brains in the country and has a personal interest in making it a success

2) It has the buy-in of the top political leaders in the country as well as of their Singapore counterparts through the joint ministerial committee

3) It is the natural hinterland to Singapore, where costs are far higher, and is within eight hours’ flight from key Asian countries, including China, India and the Middle East

4) The political friendship between the two countries is probably at its highest point in many years with numerous outstanding issues of the past addressed

5) The recently-completed catalyst projects that draw in big crowds – LegoLand and the Puteri Harbour Theme Park – make Iskandar highly visible and exciting

6) Other catalysts, including numerous education institutions, the Johor Premium Outlet and Pinewood Studios, have been completed or are nearing completion

7) There are many more catalyst projects in the pipeline, including the MotorCity, China Mall, Ascendas industrial estate, Danga Bay, Desaru and Pengerang projects, which will keep Iskandar’s momentum going

8) Accessibility is being improved significantly through infrastructure projects, including new highways, LRT/MRT connectivity, ferry/MRT connection to Singapore and high-speed rail

9) Hugely successful recent property launches by UEM Land, United Malayan Land, WCT and SP Setia have attracted the interest of other developers

10) Many soft issues are being looked into, including safety (there is a Safety and Security Blueprint) and ease of movement for Singaporeans (there is a proposed Free Access Zone), which will enhance Iskandar’s attractiveness

2. BACKGROUND

2.1 Going back to the very beginning

Iskandar can trace its roots to the Nusajaya township in Johor that began life as the Prolink 2020 project. Prolink 2020 was the brainchild of Tan Sri Halim Saad, the then major shareholder of Renong Berhad (subsequently renamed UEM World). The Prolink 2020 project was conceived in the early-1990s and, at 23,875 acres, was touted as the largest private township in Asia. The landbank came about as part of the construction of the Malaysia-Singapore Second Crossing as the highway connecting the North South Expressway to the second bridge to Singapore cuts through Prolink 2020. At that time, the township was estimated to have a GDV of RM8bn-9bn and a population of 500,000 when completed within 20 years. There were grand plans for the township then, including the development of duty-free shopping and education institutions.

We first visited the Prolink 2020 project in mid-1997, shortly after the maiden launch of Nusajaya on 14 April 1997. Even then, launches in the township were well-received, with a three-day queue for the official maiden launch of 600 mixed development units. Demand for link houses priced RM193,000-350,000 was strong as 216 non-Bumi units were fully sold out on the day of the launch. Likewise, SP Setia’s maiden launch of the 1,600-acre Bukit Indah township in Nusajaya (land which Renong sold to SP Setia) during the first week of May in 1997 was also well-received. Of the 850 link houses priced RM200,000-250,000, approximately 85% of the non-Bumi units were quickly snapped up.

2.2 Khazanah comes into the picture

The 1997/98 Asian financial crisis caused major disruptions to the Malaysian economy, including to Renong and the Prolink 2020 project, which eventually led to the ownership of Renong and UEM Holdings changing hands from Tan Sri Halim Saad to Khazanah Nasional. Under Khazanah, the Renong-UEM Group underwent several restructuring exercises, which resulted in Nusajaya being listed under UEM Land Holdings in 2007. Via UEM Land, Khazanah emerged as one of the largest development land owners in Johor, which probably led to it taking on an enlarged role in the planning of the entire Iskandar Malaysia.

In 2005, Khazanah became the planner for the Iskandar Malaysia development corridor. Iskandar was one of five development corridors launched in 2006 under the 9th Malaysia Plan but was arguably the most important. In addition to its planning role, Khazanah was identified to play an investment role for catalyst infrastructure and development projects, such as the Johor State New Administrative Centre, the Southern Johor Industrial Logistic Cluster, Waterfront City, Medical Hub, EduCity and a proposed international destination resort. These initiatives were to complement the many existing and ongoing developments in the state, such as the Port of Tanjong Pelepas, Senai Airport, Danga Bay and Johor Corporation.

2.3 Iskandar Malaysia as we know it

Previously known as the Iskandar Development Region, Iskandar Malaysia measures 2,217 sq km (547,669 acres) in total and aspires to be a self-contained, sustainable metropolis of international standing. It is three times the size of Singapore and twice that of Hong Kong and covers the southern part of Johor from the Senai Airport to the eastern and western coastal areas, including the capital of the state, Johor Bahru.

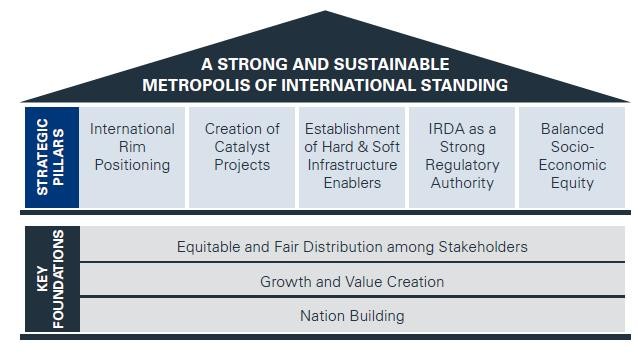

Iskandar Malaysia’s five main strategic pillars are:

1. International rim positioning – Iskandar is located mid-way between China and India and is 4-8 hours’ flight from Bahrain, Delhi, Dubai, Hong Kong, Hanoi, Ho Chi Minh, Shanghai and Taipei.

2. Establishing hard and soft infrastructure enablers – This is not limited to physical infrastructure, such as roads, airports, ports and utilities, but also encompasses security, river cleaning and proper sewerage. Fiscal and financial incentives, human capital as well as efficient and business-friendly institutions are included too.

3. Investment in catalyst projects – This is to spur further economic activity in the region. This includes projects in logistic services, financial services, health and education services, agricultural, manufacturing and leisure and tourism.

4. Establishing a strong institutional framework and the creation of a strong regulatory authority – The Iskandar Regional Development Authority (IRDA) represents a joint and coordinated approach between the federal, state and local governments, co-chaired by the prime minister and the chief minister of Johor.

5. Ensuring socio-economic equity and buy-in from the local population – To ensure the local population of Johor will benefit from the development, Iskandar will address the issues of property and equity ownership, local and Bumi participation, business and income improvement and employment opportunities.

IRDA was established as a statutory body under the IRDA Act of 2007 and has been appointed as the development authority and a one-stop centre for investors. This includes for planning and land matters, licences and permits, immigration, business set-up and incentives. It is responsible for realising the vision and objectives of Iskandar towards becoming a metropolis of international standing. To facilitate investments into Iskandar Malaysia, IRDA has established the Iskandar Service Centre (ISC) and the Approvals and Implementation Committee (AIC). ISC acts as the principal coordinator and facilitator for approvals in Iskandar while the AIC serves to identify, monitor and coordinate the relevant government entities to expedite the approval and implementation of strategic investments in Iskandar.

One of the primary goals of Iskandar is to attract FDI, especially in areas that will boost Malaysia’s competitiveness. This is in view of Malaysia’s lower labour cost-competitiveness relative to some of its regional peers. The four new sectors of focus that were added to the existing five include healthcare, education, financial and creative industries. Iskandar’s industrial plans are aimed at developing it into Asia’s premier hub for high technology and emerging technology manufacturers in the electrical and electronics, petrochemicals and oleochemicals, and food and agro-processing sectors.

Iskandar’s integrated development is guided by the Comprehensive Development Plan (CDP) 2006-2025. The CDP addresses socio-economic development guided by its main pillars and anchored on four basic foundations and supporting systems. To garner Singaporean feedback for Iskandar, there is also a Malaysia-Singapore joint ministerial committee that meets up occasionally to resolve any issues that may crop up.

2.4 Five flagship zones in Iskandar Malaysia

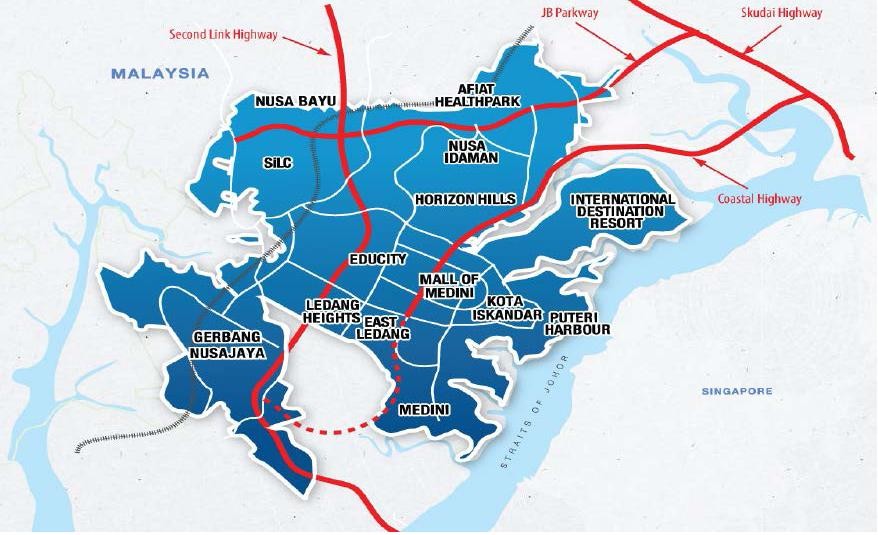

There are five flagship zones in Iskandar. We believe Nusajaya is the heart of Iskandar as that is where Khazanah and UEM Land have a blank canvas to work on and where most of the key catalyst projects are taking place.

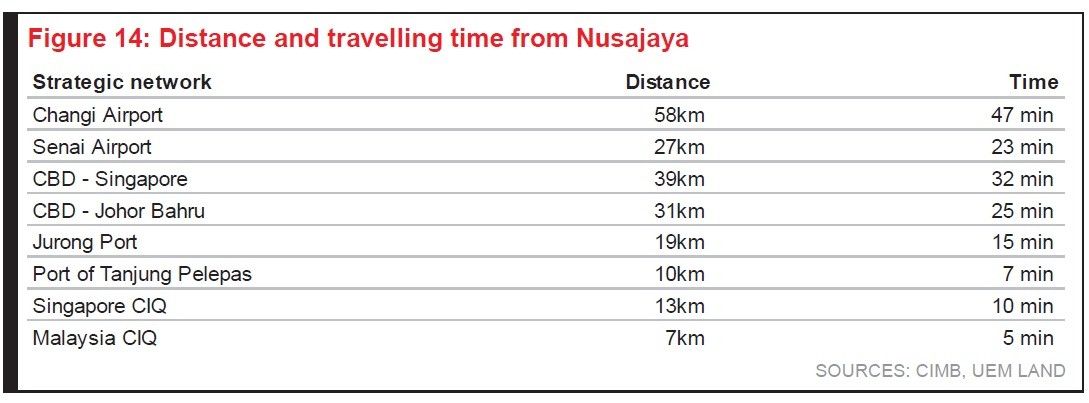

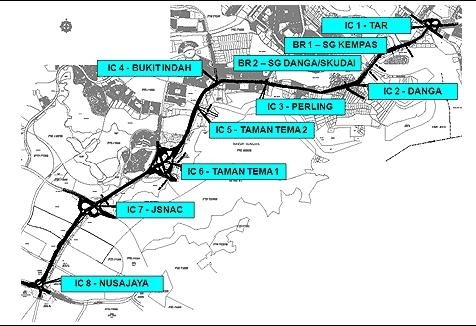

Nusajaya has been repositioned as a regional city with diverse catalyst developments catering to global market demands. The main advantage of Nusajaya is its proximity to Singapore where land prices and the cost of doing business are significantly higher. The centre of Nusajaya is located 27km or 23 minutes’ drive from Senai Internation al Airport and 31km or 25 minutes from the Johor Bahru city centre to the east and Port of Tanjung Pelepas to the south-west. A toll-free government-funded coastal highway costing RM1bn was completed at end-2011 and cut travelling time to Johor Bahru city centre from 30-35 minutes to only 10-15 minutes.

al Airport and 31km or 25 minutes from the Johor Bahru city centre to the east and Port of Tanjung Pelepas to the south-west. A toll-free government-funded coastal highway costing RM1bn was completed at end-2011 and cut travelling time to Johor Bahru city centre from 30-35 minutes to only 10-15 minutes.

Nusajaya is in Zone B of Iskandar and is targeted to have a population of 500,000 by 2025. Current economic activities there are focused towards mixed property development, state and federal administration and warehousing. In future, Zone B will be the hub for high-tech manufacturing and biotechnology as well as the creative, medical, education and tourism sectors.

UEM Land is the major land owner and master developer of Nusajaya with Iskandar Investment Berhad (IIB) playing a significant role too. Key catalyst projects in Nusajaya include the state administration centre, the Southern Industrial & Logistics Clusters (SiLC), the Medical Hub, EduCity, Puteri Harbour, Pinewood Studios and an international destination resort (theme park). More recently, new catalyst projects, including the MotorCity and the China Mall, have emerged.

IIB is 60%-owned by Khazanah, 20% by the Employees’ Provident Fund and 20% by the Johor state government. IIB’s role is to promote, coordinate and invest in strategic and catalytic projects and to engineer public-private partnerships to accelerate and enhance the development of Iskandar. IIB also owns large tracts of land in Nusajaya, some acquired from UEM Land as part of its restructuring exercise.

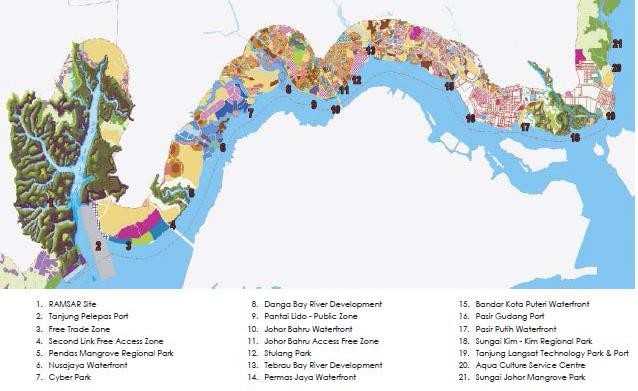

Zone A in Iskandar is Johor Bahru or the capital of the state. Current economic activities in Zone A are financial services, commerce, retail, arts and culture, hospitality, urban tourism, plastic manufacturing, electrical and electronics and food processing. A multi-modal terminal is being planned for Zone A as well as an MRT/LRT system connecting Johor Bahru with other parts of Iskandar. Danga Bay is also located in the Johor Bahru area and is enjoying strong interest from investors and developers. As the largest recreational park in the city, Danga Bay spans 1,840 acres and will include financial, commercial, residential, lifestyle, leisure and family-oriented developments. A new CBD is being planned for Johor Bahru that would encompass 392 acres and three precincts: 1) Johor Bahru City Waterfront Precinct, 2) Heritage Precinct, and 3) the Business and Central Park Precinct. These plans, however, may be modified.

In 2012, Iskandar Waterfront Holdings (IWH) was created to undertake developments in Johor Bahru, encompassing Danga Bay, Johor Bahru city centre and the Tebrau Coast. The site stretches along a 25km-long scenic waterfront facing the Straits of Johor and covers a total landbank of about 3,000 acres. From the Johor-Singapore Causeway, this landbank covers the waterfront of the east, centre and west of the Johor Bahru city centre. IWH will spearhead the transformation of Johor Bahru into a new iconic business destination and towards becoming the single largest integrated urban development project in Malaysia. IWH is a strategic partnership between the Johor state government and businessman Tan Sri Lim Kang Hoo. In addition, Khazanah and EPF have stakes in promoting development in this area via their interests in the subsidiaries and associated companies of IWH.

Zone C in Iskandar is the Western Gate Development and the main activity here includes marine services, warehousing, logistics, engineering, hi-tech manufacturing, food products, petrochemical, entrepot trade, regional procurement centres and utilities. MMC Corp is the main player in Zone C via Port of Tanjung Pelepas (PTP) and the 2,100MW coal-fired Tanjung Bin power plant. Around 700 acres of land in the Free Trade Zone in PTP is available for investment and there are another 2,215 acres at the US$5bn Maritime Centre at Tanjung Bin for investment by oil & gas players. Global players with facilities within the free zone include Maersk Logistics, Schenker Logistics, Geodis International, Naigain Nitto, Nippon Express, BMW Asia Pacific Spare Parts, Flextronics, CIBA Vision, JST Connectors and Cameron International Malaysia Systems. The Maritime Centre will comprise oil terminal activities, drydocks, a shipyard, conventional cargo-handling facilities, logistic parks and real estate development. There is also around 5,400 acres of land available for real estate development for port support services, including a residential section, a logistics office complex and training centre and commercial, industrial and recreational areas.

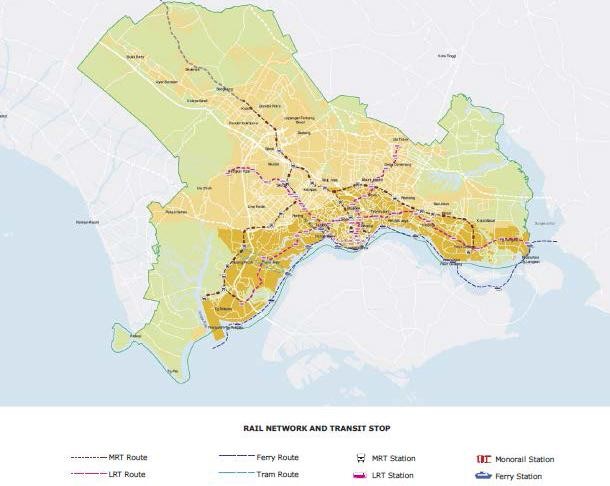

Zone D in Iskandar covers the industrial and manufacturing hub, including Pasir Gudang Port, Pasir Gudang Industrial Park, Tanjung Langsat Port and Tanjung Langsat industrial complex. Economic activities focus on heavy industries, ports and logistics and warehousing. There is even a motor racing circuit there, the Pasir Gudang Circuit, which is the first international class circuit outside the Klang Valley. Also in the Comprehensive Development Plan is a proposal to build a 59km light rail transit system from Pasir Gudang to Nusajaya. Estimated to cost RM2.66bn, the project’s implementation phase is targeted to span from 2016 to 2020.

Zone E covers the Senai-Skudai area where the key economic activities evolve around airport services, engineering, manufacturing and education. Plans for Zone E are to expand into agro and food processing, ICT and retail tourism. Senai Airport is being positioned to become the no. 2 airport in the region after Changi by 2025. A multi-modal terminal and cyber city will be developed and an MRT/LRT system built to connect Zone E with other parts of Iskandar. It is estimated that between the Kempas, Senai and Kulai industrial areas, there are over 10,000 acres of land available for investment.

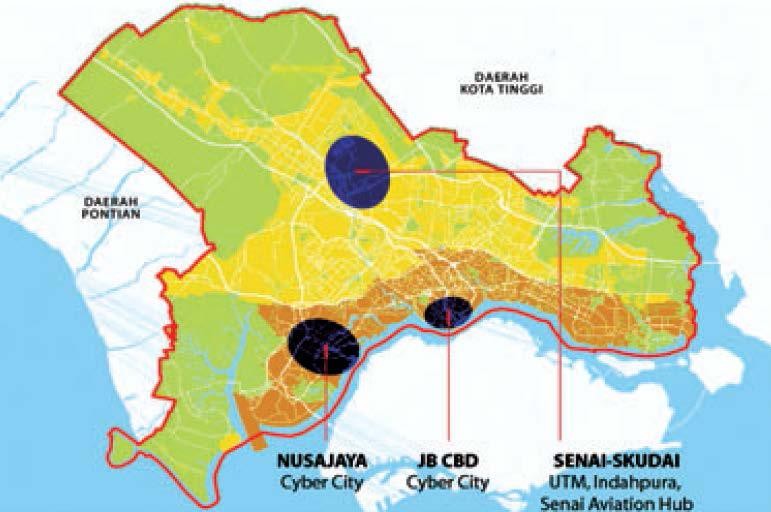

CyberCities in Iskandar Malaysia

2.5 Other key areas in Iskandar Malaysia

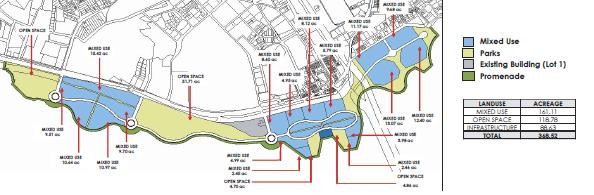

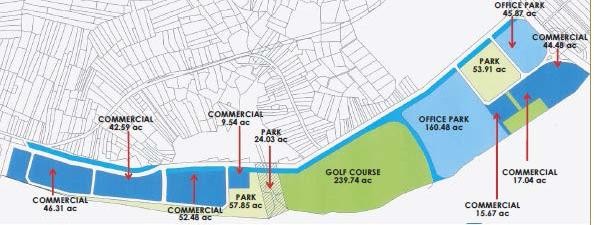

Beyond the five flagship zones in Iskandar, there are several areas that are important features on their own. These include the coastal areas in Johor and the Free Access Zone in Nusajaya. The Johor coastal areas offer prime waterfront development opportunities. It would be an attractive new feature of the city and provide public spaces for a growing population. Again, it is uncertain how much of the original plans will be kept and how much modified due to the emergence of IWH. Nonetheless, the original plans estimated that 100 acres of parks and open spaces would be created. This area would connect Johor Bahru city with Danga Bay. Plans include the reclamation of 250 meters of land to create a new shoreline.

As for the proposed Nusajaya Free Access Zone, it was originally slated to be located just off the western part of the second crossing and measures 1,029 acres. The plan was to create a seamless work and living environment between Johor and Singapore where there are no limitations on duration of stay and access. A smart card system will facilitate moving in and out of the area and the plan is to attract Singaporeans to live in the zone and commute to work in Singapore. Direct access to the zone from neighbouring areas would be strictly controlled and a 30m bund would be created while a canal 30m in length would be built along this bund for retention and security purposes.

Major developments along coastal areas

Johor Bahru coastal development

2.6 Infrastructure in Iskandar Malaysia

To facilitate development of Iskandar, there are plans for LRT, MRT, tram, monorail and even ferry transport. This is to alleviate road traffic congestion and to complement public transportation. The LRT is to provide intercity connectivity while the monorail is to serve the CBD of Johor Bahru. A high-speed rail linking Kuala Lumpur to Johor Bahru is also on the cards and recent reports have indicated suggestions that the stop be in Nusajaya. Another proposal is to link the Singapore MRT system with Iskandar, which is forecast to be completed by 2018. The international ferry terminal in Puteri Harbour has just been completed and will facilitate the arrival of Singaporeans.

Proposed comprehensive public transportation system

Puteri Harbour International Ferry Terminal

Another issue of critical importance to Iskandar is safety. The Safety and Security Blueprint was completed and endorsed in 2009 and assists the public sector, private sector and the community to cooperate in building a safe environment. IRDA has been working closely with the Royal Malaysia Police to ensure safety is continuously addressed and crime reduced. Some of the actions taken since 2007 include increasing police presence in Iskandar, designating new police districts and reinforcing existing districts, launching additional beat bases, introducing high profile mobile policing, establishing a special task force for investors, installing CCTVs at hot spots and augmenting police presence with auxiliary police.

2.7 Developments near Iskandar Malaysia

Massive property and oil & gas developments taking place in Desaru and Pengerang, which lies east of Iskandar, will also spur developments in the state. Recall that in mid-2012, UEM Land acquired a 51% stake in 679 acres of leasehold land in Desaru, Johor, from its parent Khazanah for RM247.5m, valuing the land at RM16.40 psf. The Desaru landbank is located in the Desaru coastal area in the eastern part of Johor and is accessible via the 27km Senai-Desaru Expressway, which was completed in mid-2011. It is also accessible via sea from the Changi ferry terminal in Singapore. There are ongoing plans to develop Desaru into a world-class resort and tourism destination comprising golf courses, a retail village, convention centre and themed attractions. GDV of the 679-acre project is estimated at RM5.4bn. Development of the project is expected to take 20 years.

The land UEM Land acquired is located next to two major golf courses that will be constructed by Khazanah. UEM Land will develop residential properties priced at a fraction of other 6-star resort developments in the vicinity. The 679 acres are merely one portion of the 6,000 acres that Khazanah owns in the Desaru area. Other portions will be developed by internationally-renowned resort companies. A water theme park covering 40 acres will also be built. The Desaru project makes sense as it is a catalyst project in Johor that will complement Iskandar and add breadth to the entertainment offerings of the region. As for the development of Pengerang, please refer to the section of this report titled “Oil & gas perspective” for details.

3. ECONOMIC PERSPECTIVE

3.1 Iskandar – a growth-catalytic corridor

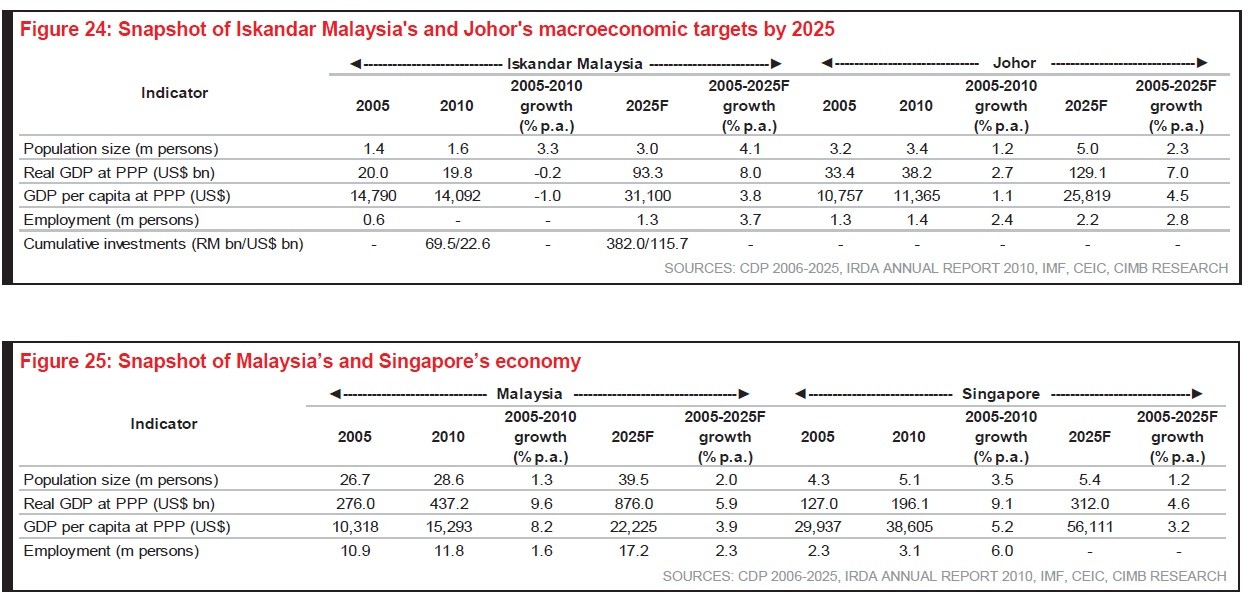

All through the last six years since 2006, Iskandar has defied gravity to deliver impressive development progress, becoming the country’s fastest growing corridor. Nine major economic clusters have been picked to spearhead and fast-track the corridor, with services and manufacturing sectors leading the pack. The Comprehensive Development Plan (CDP) has set 20-year macro and investment targets to transform Johor into a world-class state. Since Iskandar was launched on 4 Nov 2006, its investment value has exceeded the Phase 1 (2006-2010) target by 47.9%. Total committed investments of RM36.8bn in 2011-12 already make up 50.4% of Phase 2’s target of RM73bn for 2011-15.

3.2 Iskandar a boon to Johor and Malaysia

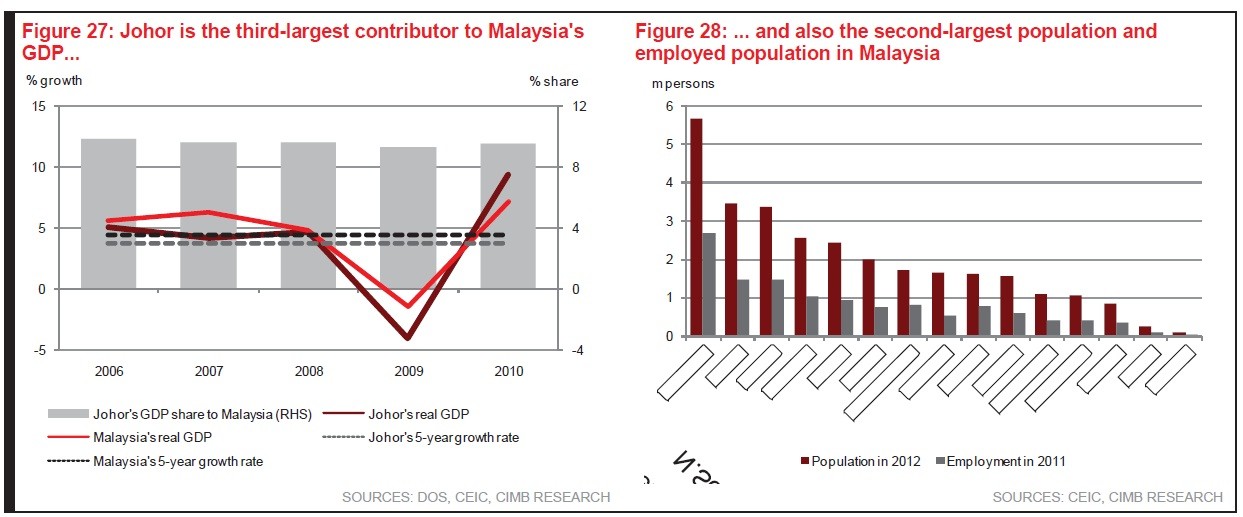

We are convinced that the “Iskandar effect” would not only enlarge the economic pie of Johor state in particular but also enhance Malaysia’s strategic position as an investment destination in ASEAN. Iskandar, which accounts for about 60% of Johor’s economy in nominal terms, would act as a prime growth catalyst and complement Johor’s overall economic contribution to the Malaysian economy. Johor is the fifth-largest state by land area and now the second-most populous in Malaysia. Iskandar constitutes 45.6% of the Johor population and half of total employment there.

The Johor state’s GDP size of RM53.2bn is the third-biggest contributor to Malaysia’s GDP (9.3-9.8% each year) with 60% coming from the Johor Bahru area. The state’s economy expanded 3.7% p.a. in 2005-10, moderately below the national real economic growth of 4.4% p.a.

There is growing international recognition of Iskandar’s position as Malaysia’s future engine of growth. In Jul 2012, TIME magazine called it “one of the most ambitious development projects in the world.” It praised Iskandar’s geographical advantages: with two ports straddling the Straits of Malacca and the South China Sea, “it sits at the fulcrum of global trade.” In Dec 2012, the New York Times featured Iskandar in an article titled “Massive Education Complex Takes Shape in Malaysia”, saying that “Nusajaya’s lush green fields, neatly paved roads and two theme parks will eventually become a second home to more than 16,000 students.”

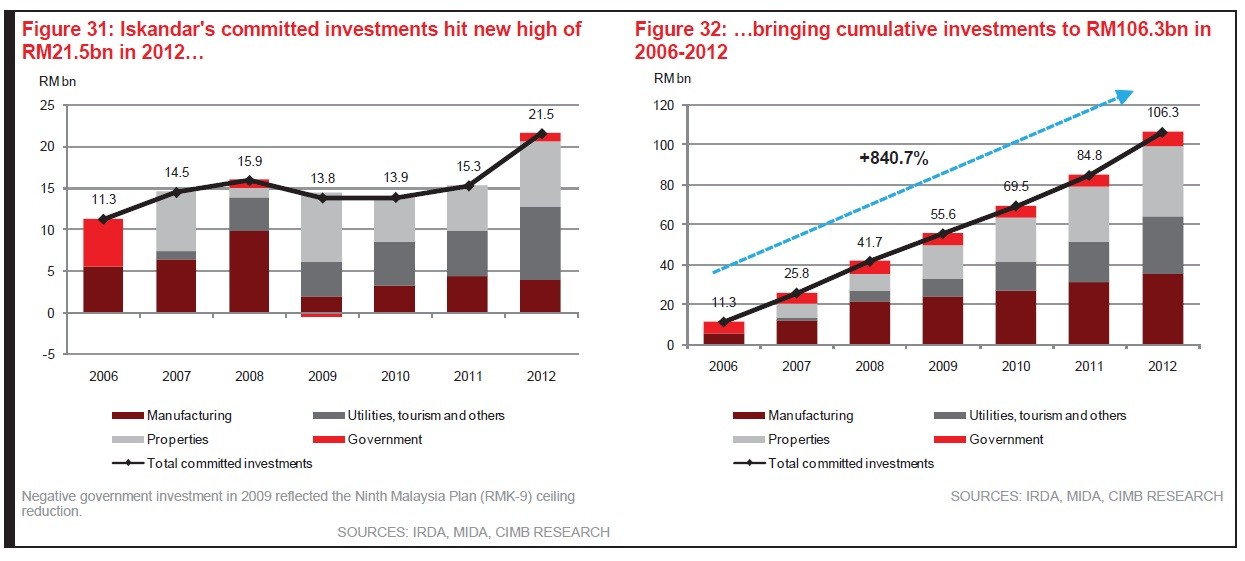

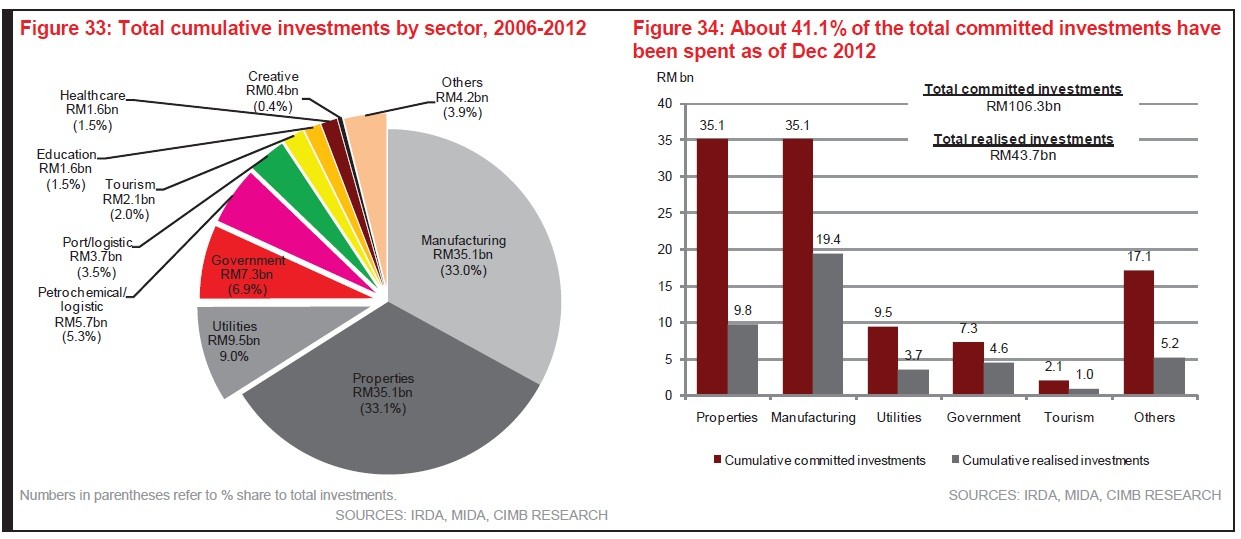

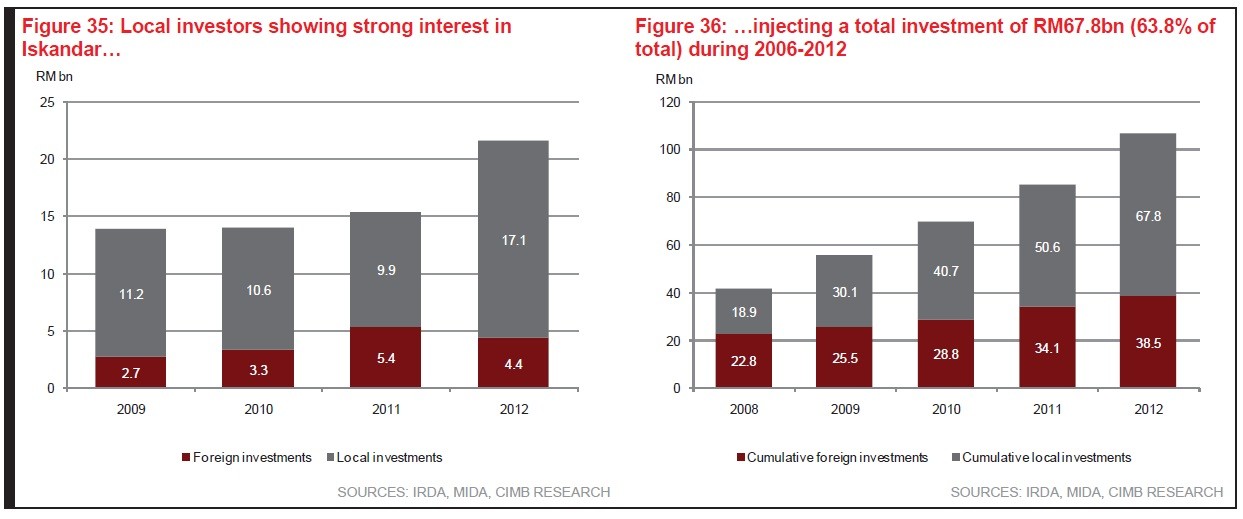

3.3 Catalytic infrastructure and investment on track

Skeptics were amazed by Iskandar’s boom, engineered by investments from both domestic and foreign investors. The megaproject is on track to be completed by 2025, with about a quarter already completed. Between 2006 and Dec 2012, Iskandar attracted investments totalling RM106.31bn, an exponential jump of 841% from a slow start of RM11.3bn in 2006. YTD cumulative investments are equivalent to 11.3% of 2012’s GDP. On average, total committed investments surged 45.3% p.a. or RM15.8bn a year in 2006-2012. What is most encouraging is that 41.1% of the total committed investments have been spent to-date, resulting in the positive trickle-down on the economy, employment and output. Among the five growth corridors, Iskandar has emerged as the second-largest recipient of committed investment in manufacturing, services and primary sectors as at end-2012. It also generated the most employment opportunities, creating 154,000 new job openings since 2006 until Dec 2012 and making up nearly 19% of its 2025 target of 817,500 new jobs.

3.4 Broad-based and strategic investment

3.5 Investment is predominantly domestic investor-led

An array of tax/fiscal as well as non-fiscal incentives is available for approved companies located in the approved node within Iskandar. Amongst the incentives offered include exemption from income tax up to YA2015/2020, exemption from Foreign Investment Committee guidelines, flexibilities under the foreign exchange administration rules and unrestricted employment of foreign knowledge workers. The Iskandar Development Region (IDR)-status companies enjoy income tax exemption for qualifying activities in six categories of service-based sectors: creative, education, financial advisory and consulting, healthcare, logistics and tourism.

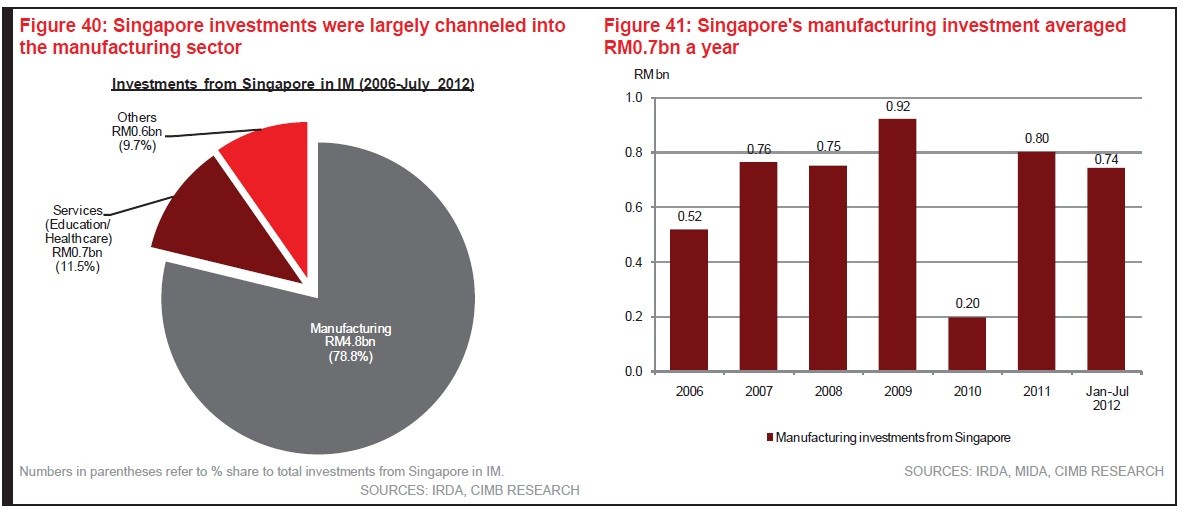

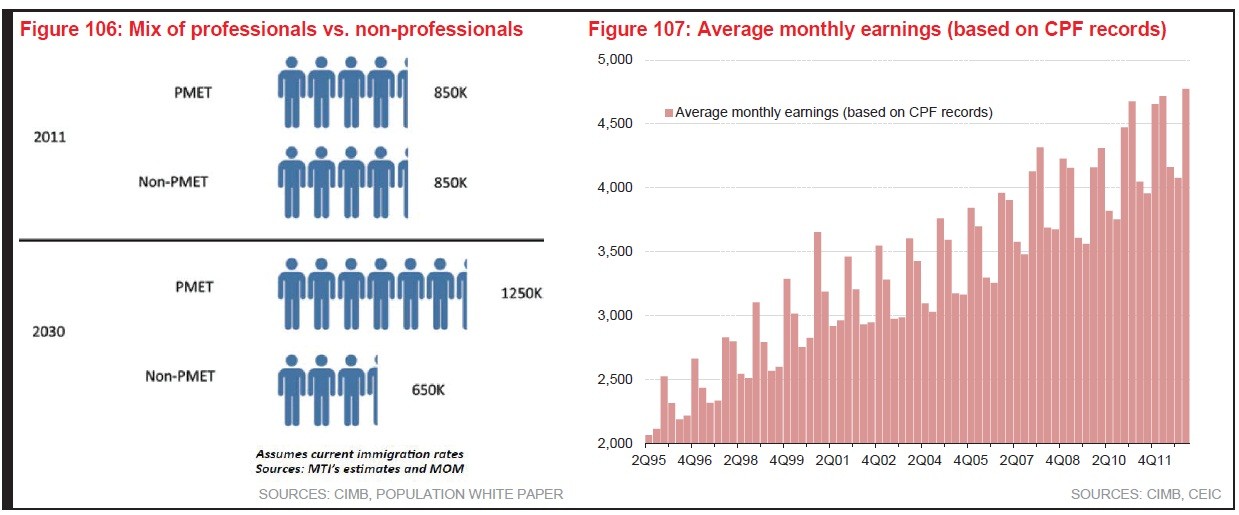

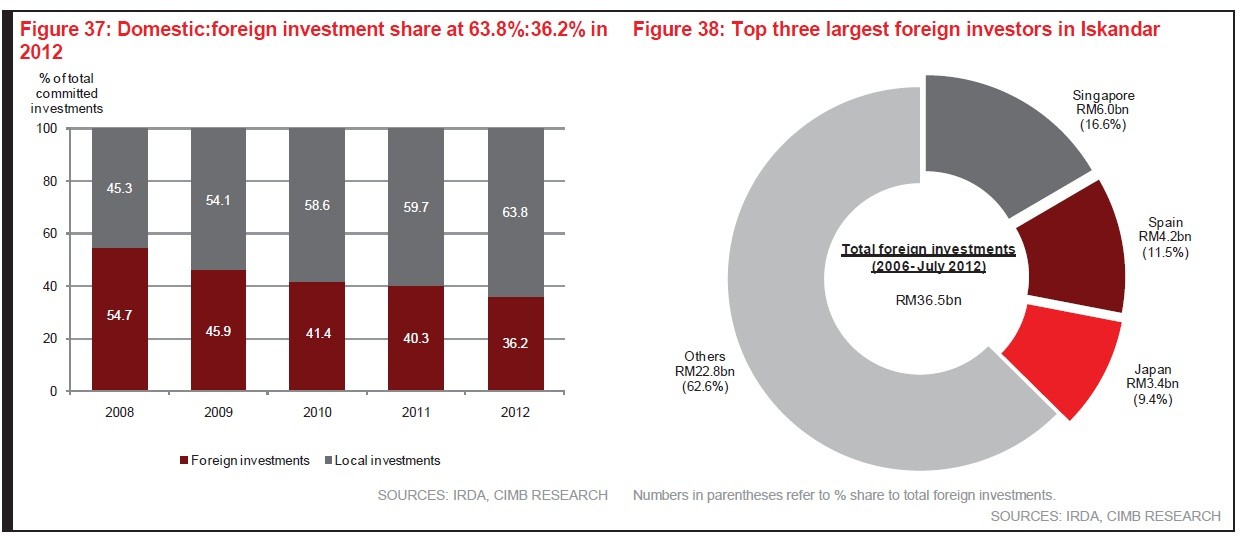

Local investors poured in more investment in Iskandar than foreigners, facilitated by a conducive investment climate and favourable incentives to draw strategic investment into the targeted industries. Since 2008, domestic investors’ share of total cumulative investments jumped from 45.3% in 2008 to 63.8% in 2012 while that of foreign investors stood at 36.2% in 2012 (vs. 54.7% in 2008). Of the total cumulative foreign investments of RM36.5bn as of July 2012, Singapore had pumped in the most at some 16.6% or RM6bn, followed by Spain (11.5% or RM4.2bn) and Japan (9.4% or RM3.4bn).

Major local investors include Tenaga Nasional Bhd, Telekom Malaysia Bhd, MMC Group, Iskandar Waterfront Development, Port of Tanjung Pelepas, Central Malaysian Properties Sdn Bhd, IOI Properties and SP Setia Group.

The notable landmarks and attractions in Iskandar are the Johor Premium Outlet, EduCity, LegoLand Malaysia, colleges and medical facilities as well as healthcare centres. Iskandar has also positioned itself as one of the strongest emerging contenders in the international market of foreign students. Iskandar Investment Bhd has signed up to 10 education institutions to set up local campuses in the 395-acre EduCity. Marlborough College Malaysia, Newcastle University Medicine Malaysia, Netherlands Maritime Institute of Technology, Raffles University Iskandar, Raffles American School and University of Southampton Malaysia Campus have already started full-time operations and the remaining institutions are expected to start by 2017. Among the latest committed investments are for the creation of a motorsports city, nanotechnology-based industries, mixed development areas, prime waterfront properties, a trade and exhibition centre, communications and ICT infrastructure and a global innovation centre.

The biggest beneficiary of the fast-track implementation of infrastructure and catalytic projects in Iskandar is the broad property sector. We saw established local and foreign developers starting to build residential, commercial and industrial properties as well as integrated townships and shopping malls.

Going into 2013, key focus sectors will be healthcare, creative (indications are that Pinewood Iskandar Malaysia Studios will open in May 2013) and logistics, including business process outsourcing (BPO) and shared services outsourcing (SSO). We expect the oil & gas and food and agro-processing (including halal) sectors to spearhead growth in the manufacturing sector.

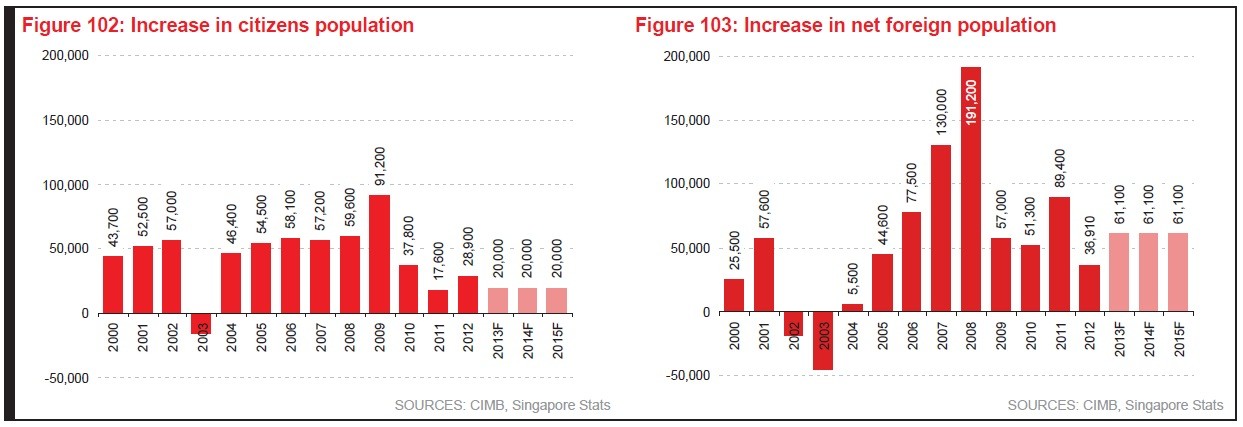

3.6 Johor-Malaysia-Singapore connectivity

As the natural link to Singapore (and its close proximity to the Iskandar project), Johor’s growth is an indication of the positive “Iskandar effect”, which would 1) spin off vibrant economic and investment connections within Malaysia, and 2) drive a greater flow of investment and services as well as people between Malaysia and Singapore. Iskandar’s image as a thrilling growth corridor in the region has created a lot of interest and excitement among Singaporeans given the island economy’s close proximity to Johor Bahru. A new trend appears to be emerging as more Singaporean citizens opt to stay here and travel to Singapore for work.

The growing as well as enhanced bilateral ties between Malaysia and Singapore will provide an added growth stimulus to the development of Iskandar. The latest game-changer announcement of the construction of a high-speed rail (HSR) link between Kuala Lumpur and Singapore marks a new era of enhanced connectivity between the two countries, which will create greater economic activity on both sides of the border. Improving mobility and accessibility will lead to increased employment opportunities, more economic and investment activities as well as higher demand for services, including for real estate in the two countries and along the HSR stops. The externalities from increased rail, road and sea links between Malaysia and Singapore will spur regional connectivity among ASEAN countries.

3.7 Convincing buy-ins from Singaporean investors

In the early days of Iskandar’s inception and development, Singapore investors adopted a cautious approach, taking time to assess whether the “mammoth” growth corridor can take off as planned. Now, the astonishing development progress in Iskandar, along with continued strong endorsement from both prime ministers, has changed Singaporean investors’ perceptions. It is a win-win situation for both countries.

We saw an increase in Singaporean investors’ investment in Iskandar, which is a clear signal that rising costs of living and doing business in Singapore, together with higher labour costs, are pushing companies to relocate to Johor as part of their long-term business planning strategies. As of July 2012, Singapore maintained its position as the largest foreign investor in Iskandar, pouring in a cumulative committed investment of RM6bn or 16.6% of total foreign investments in Iskandar since 2006. The manufacturing sector, especially the E&E sub-sector, received the greatest portion of total investments of 78.8% or RM4.8bn, followed by the services sector (RM0.7bn or 11.5%), largely in the education sub-sector. In the services sector, out of three projects invested in by Singapore, more than RM100m of its pledged investments went to healthcare, undertaken by Singapore-listed Health Management International (HMI) into the 218-bed Regency Specialist Hospital on the eastern side of the Iskandar Malaysia region. The other two projects are the proposed Raffles University and Raffles American School.

Looking ahead, more strategic investments from Singapore are expected to flow into Iskandar given the increasing growth prospects and investment opportunities offered. The strengthening of bilateral ties is also playing a part to facilitate more two-way economic connectivity between Malaysia and Singapore.

4. PROPERTY PERSPECTIVE

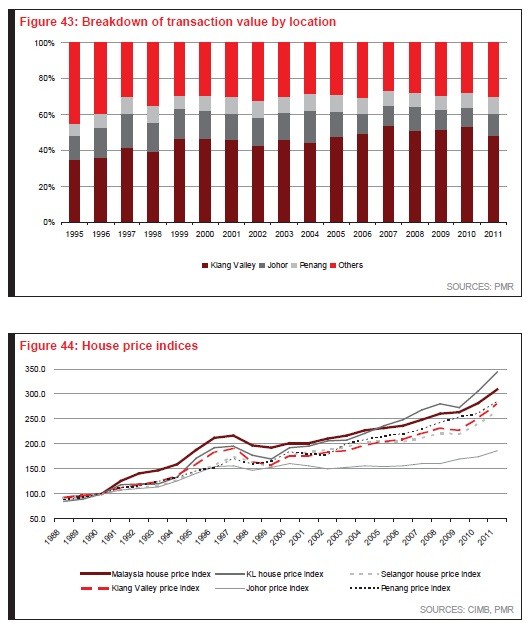

4.1 Johor coming back to life?

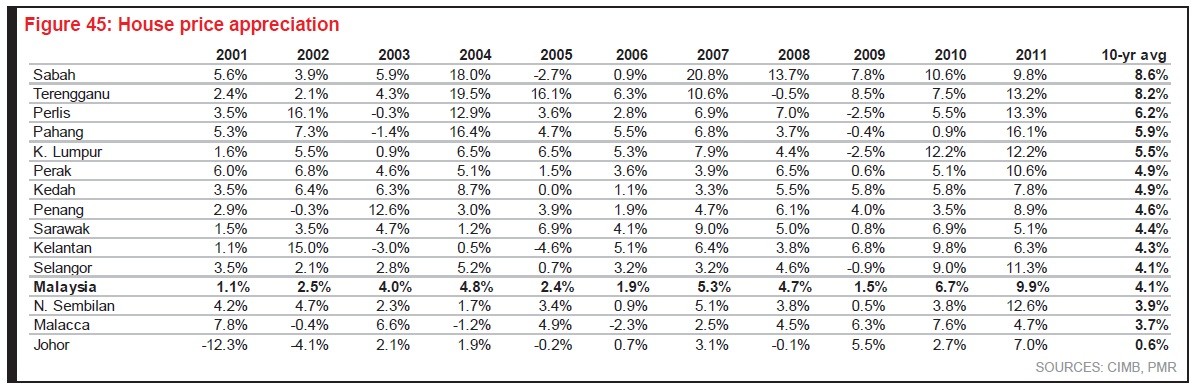

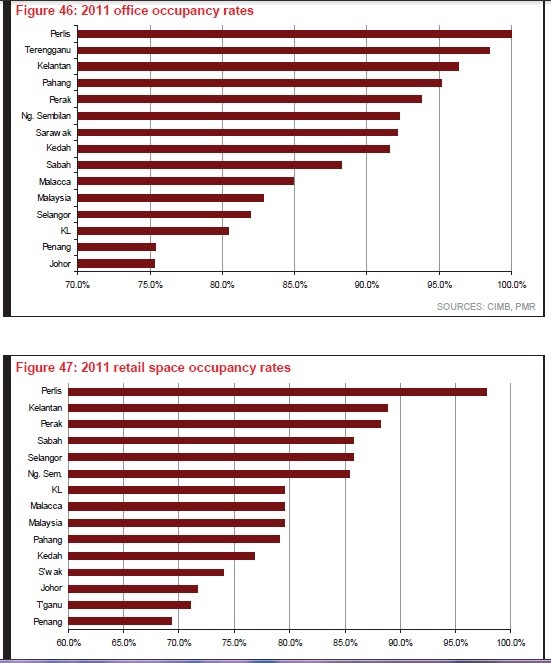

Johor may be the second-largest property market in Malaysia after the Klang Valley but residential prices in Johor have been the worst performer over the past 10-15 years. Johor’s 10-year price CAGR was a pitiful 0.6%, way below even the inflation rate and the country’s average house price CAGR of 4.1%. This is due to many factors, including intense competition, oversupply and lack of confidence. Even on the property investment front, Johor suffers from the lowest office occupancy rate in the country and the third-lowest retail occupancy rate. Both office and retail occupancy rates are in the low 70s percentile range. But all of that could change in the coming years.

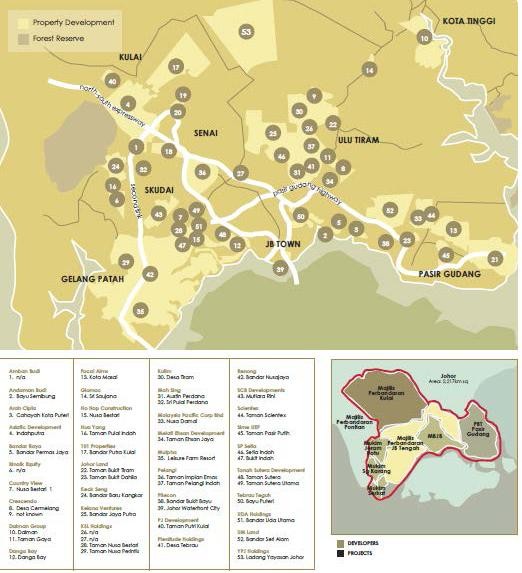

4.2 Lots of players

Property development appears to be the biggest beneficiary of Iskandar and arguably the best way to play the Iskandar theme. There are over 20 listed developers with landbank in Iskandar and investors are spoilt for choice. But for many developers, Iskandar or even the wider Johor exposure makes up a relatively modest percentage of their landbank and sales. The exceptions, of course, are the Johor developers but these companies are relatively small and off the radar screen for most analysts.

4.3 UEM Land the best proxy

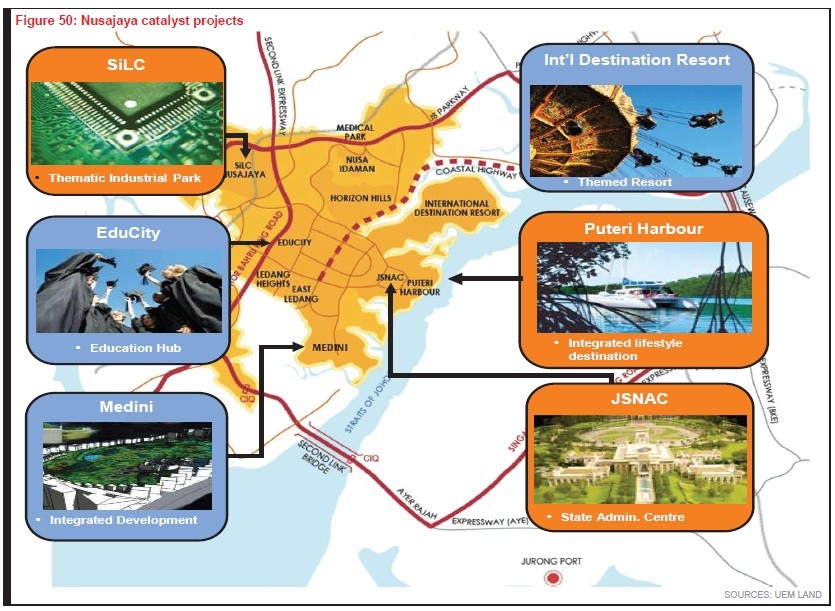

UEM Land has arguably the largest and best landbank in Iskandar. UEM Land is the main developer of Nusajaya, which is in Zone B, and there are numerous catalyst projects situated there. There are seven catalyst developments in Nusajaya that will help accelerate the development, namely the Kota Iskandar administrative centre, Puteri Harbour, a thematic industrial park (SiLC), a medical park, an international destination resort, education hub (EduCity) and Medini. The international destination resort, EduCity and Medini developments are held directly by IIB.

Kota Iskandar administrative centre – The administrative centre for the Johor state government measures 320 acres and Phase 1 has already been completed. Some 2,200 employees of the state government have moved into the offices since Apr 09. Phase 2 covers a mosque as well as state government staff housing while Phase 3 covers the federal administrative buildings. The total GDV for Phase 2 and 3 is RM1.1bn.

Puteri Harbour – Puteri Harbour is sandwiched between Kota Iskandar and the Straits of Johor. It measures 688 acres and has 10.8km of waterfront. The theme of Puteri Harbour is waterfront living and it will encompass upmarket properties with relatively high densities. There will be canal homes, condos, marinas, a convention centre, transport hub, resorts and hotels as well as fine dining and lifestyle stores. In total, there will be more than 30m sq ft of net floor space for sale, of which 60% is for residential, 30% for commercial and 10% for retail purposes. Total GDV is estimated at RM20bn and the project is expected to take 13 years to complete, i.e. from 2007 to 2020.

A key attraction within Puteri Harbour is the Family Indoor Theme Park that Khazanah built at a cost of RM350m. The theme park was completed in 2012 and features world-renowned and popular children’s characters, including Barney, Thomas & Friends, Hello Kitty and Bob the Builder. The theme parkmeasures 60,000 sq ft and other components of the project include a 100,000 sq ft retail centre and a 300-room Traders Hotel.

Development of Puteri Harbour has been expedited via land sales and joint ventures. In Dec 2007, UEM Land sold 111 acres of land to its joint venture company with Dubai-based Limitless Holdings for RM242m or RM50 psf. Limitless, which is part of the Dubai state-owned investment group Dubai World, held 60% in the JV company while UEM Land owned 40%. Due to financial difficulties as a result of the global financial crisis, Bandar Raya Development took over the development rights to the 111 acres from the joint venture.

Another joint venture in Puteri Harbour is a 50:50 JV with United Malayan Land to develop the Somerset serviced apartments with a retail block. The project has been sold out with pricing hitting as high as RM1,000 psf. In Apr 10, UEM Land sold outright a 3.3-acre piece of land to Encorp for RM26m or RM180 psf that is being developed into a residential and commercial building with GDV of RM330m. Prices at Encorp’s condo have set new benchmarks in Puteri Harbour of over RM1,000 psf. In mid-2011, UEM Land sold a 3.2-acre piece of land for RM31m or RM220 psf to Tiong Nam Logistics to develop a hotel and serviced apartments.

In Jan 2013, UEM Land sold 44 acres of land in Puteri Harbour for RM401m or RM210 psf to Liberty Bridge Sdn Bhd, which is equally owned by Multi-Purpose Holding’s Tan Sri Surin Upatkoon, KL Kepong’s Tan Sri Lee Oi Hian, Tan Sri Wan Azmi Wan Hamzah and chairman and managing director of UOB-Kay Hian Holdings Ltd Wee Ee Chao. The pricing of the land appears to be relatively low due to its large size and lower plot ratios. UEM Land stands to reap significant profits from this land sale that will be recognised in 2013.

UEM Land has launched two wholly-owned projects in Puteri Harbour since 2011. In end-2011, UEM Land launched the Imperia condos, which were priced at an average of RM725 psf. At end-2012, the group launched the Teega condos, which are of slightly lower specifications but branded under the Sunrise name, and managed to fetch a higher average of RM750 psf for the first two towers and RM800 psf for the final tower. UEM Land plans to embark on two more projects in Puteri Harbour in 2013.

Southern Industrial & Logistics Clusters (SiLC) – SiLC measures 1,300 acres and is a managed industrial park based on the clustering concept. The industrial park is expected to take 33 years to complete with a GDV of around RM1bn for land only. UEM Land will promote “clean” industrial clusters around three major areas, including 1) advanced technologies of nanotech and biotech, 2) agro-based industries of food and nutrition, and 3) integrated logistics. Phase 1 and Phase 2A covering 275 acres have already been completed and UEM Land is now undertaking works on Phase 2B and Phase 2C with an additional land of 332 acres. Most of the buyers thus far have been Singapore-based companies.

Afiat Healthpark – The medical park spans only 67 acres and will primarily serve the healthcare needs of the local population. It is an integrated development with three distinctive areas covering modern medicine, traditional and complementary medicine and wellness.

International destination resort – The international destination resort space covers 3,321 acres and will be the site for large international theme parks. It will be anchored by an international theme park with a strong brand name and supported by well-known hotels as well as retail, dining and entertainment facilities. We believe that success in securing a major theme park would go far in accelerating the development of Nusajaya and the spillover to the rest of Iskandar would be very significant.

EduCity – The 395-acre EduCity will be a fully-integrated education hub consisting of world-class universities, industry-centric R&D clusters, colleges, international schools and amenities. GDV of EduCity is in excess of RM1bn over seven years. It is estimated that the student population will hit 16,000 by 2018. The Netherlands Maritime Institute of Technology (NMIT) Maritime StudiesJB City Campus and the medicine faculty of Newcastle University started operations in 2011. The University of Southampton engineering faculty and Marlborough College commenced operations in 2012. EduCity also has a 12,000-seating capacity stadium and sports complex on 22 acres of land as well as an international student village.

Medini – Medini is a major catalyst project and considered one of the flagships of Nusajaya. An agreement was signed on 29 Aug 2007 between IIB and 1) Mubadala, the investment company of the Abu Dhabi government, 2) Kuwait Finance House, and 3) Millenium, a member of the Lebanon-based Saraya Holdings Group. Medini measures 2,200 acres and a 99-year leasehold interest was transacted for US$1.2bn or over RM43 psf. Medini will be developed into a US$20bn integrated city made up of three clusters consisting of nine distinctly-themed zones.

Significant incentives were granted by the government solely for Medini, including 1) exemption from Foreign Investment Committee rules, 2) freedom to source capital globally, 3) the ability to employ foreigners freely, 4) exemption from income taxes for 10 years from commencement of business, and 5) exemption from withholding tax on royalty and technical fee payments to non-residents for 10 years from commencement of operations. These incentives are available only for the creative, education, financial advisory and consulting, healthcare, logistics and tourism industries.

Medini is a mixed-use urban development which will feature a lifestyle and leisure cluster, a logistics village, “creative park” and an international financial district. It is divided into four zones, i.e. Medini North, Iskandar Financial District, Medini Central and Medini South. Significant progress has been achieved at Medini and infrastructure works are being undertaken by WCT, costing RM767m. In addition to being awarded the infrastructure works in Jul 09, WCT also acquired two parcels of land in Medini, a residential one costing RM61m and measuring 11 acres (RM127 psf for the land and RM30 psf based on GFA) in Oct 09 as well as a 10-acre commercial parcel costing RM50m (RM115 psf for the land and RM30 psf based on GFA) in Dec 10.

The RM750m LegoLand Theme Park sits on 76 acres and is one of the key attractions in Medini. The theme park was completed last year and is expected to attract 1.2m-1.5m visitors annually. Another major development in Medini is E&O’s joint venture with Khazanah and Temasek to develop a RM3bn wellness township. Other projects in Medini include UEM Land’s 55%-owned Lifestyle Retail Mall next to LegoLand, WCT’s RM600m 1 Medini condo and the Medini Square joint venture with Bina Puri. A LegoLand-themed hotel and Phase 2 of LegoLand is under construction. Temasek will also build and own two office buildings in Medini.

Another major project in Medini is the Gleneagles Medini medical centre to be built on 15 acres of land. The hospital will provide a comprehensive and fully-integrated healthcare service platform. Phase 1 will have a 300-bed capacity while future phases will include a rehabilitation centre, nursing home and hospital residency. Phase 1 is targeted for completion in 2014. Adjacent to Medini is the RM400m Pinewood Iskandar Malaysia Studios, a collaborative project between Khazanah and UK-based Pinewood, located on 80 acres of land. The plan is to develop a world-class media production facility to produce a variety of movies and animations. Phase 1 involves 30 acres of land and is targeted for completion this year.

Other residential projects in Nusajaya – UEM Land has five residential projects in Nusajaya that are not part of the catalyst projects. This includes East Ledang, Horizon Hills, Ledang Heights, Nusa Idaman and affordable housing. East Ledang was launched in Feb 2008 and is a 275-acre project for the development of high-end guarded and gated residential properties. East Ledang has a GDV of over RM1bn and will take 6-8 years to complete. Nearly 60% of its buyers are foreigners, mostly from Singapore. Horizon Hills is a 50:50 joint venture with Gamuda. The upmarket project spans 1,227 acres and has a GDV of RM4bn. Ledang Heights measures 360 acres and is located next to East Ledang. It was one of the first projects launched in Nusajaya by the group in 1998. Nusa Idaman is a medium- to high-end hillside development and was launched in 2006. The project measures 250 acres and features precinct-based communities with a single entrance-exit and perimeter fencing. The project has a GDV of slightly over RM0.5bn. There are two social housing projects under affordable housing: Taman Nusantara measuring 650 acres and R10/R11 measuring 193 acres. Affordable house prices are regulated by the state government and start from as low as RM35,000 per unit. Margins are generally narrow, if not negative.

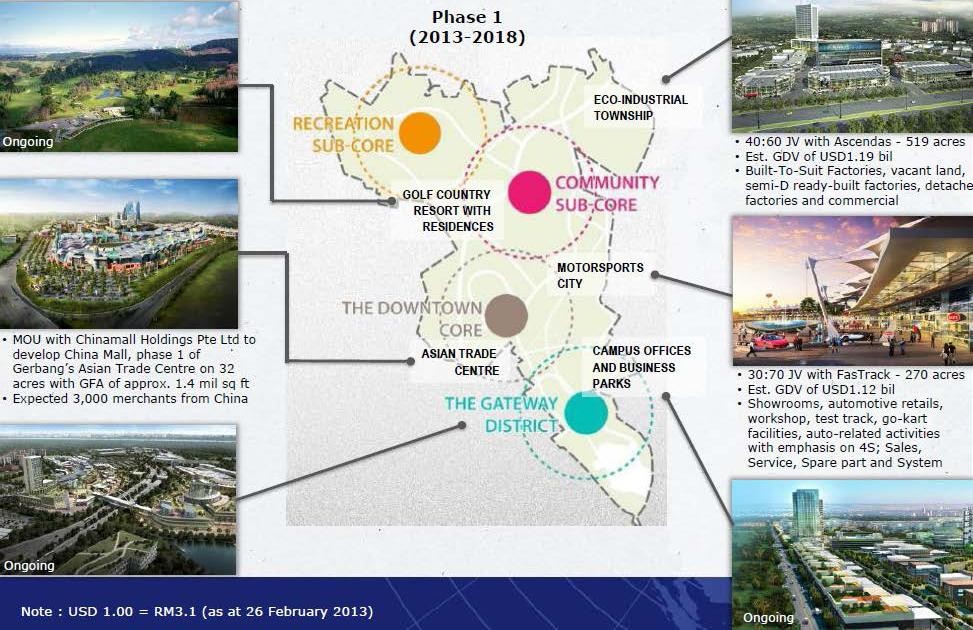

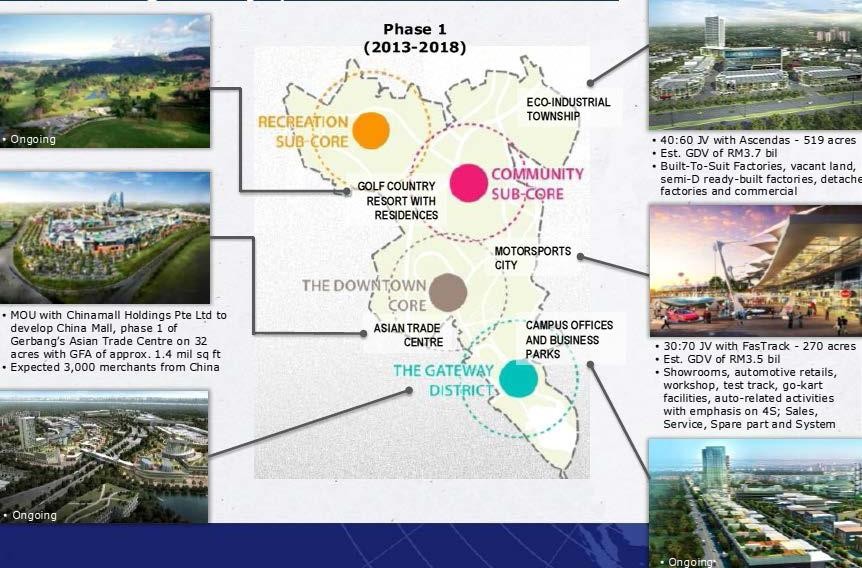

Other recent developments – Last year UEM Land’s 4,500-acre Gerbang Nusajaya development finally took off.

Translated as “Gateway to Nusajaya”, Gerbang Nusajaya is the first development that those driving from Singapore via the second crossing will pass through after customs and immigration. The project is conservatively estimated to have a GDV of RM18bn. UEM Land believes that Gerbang Nusajaya could rival, if not exceed, UEM Land’s current flagship Puteri Harbour in terms of potential. The key strategy behind Gerbang Nusajaya is to attract Singaporeans and create jobs.

The masterplan for Gerbang Nusajaya was undertaken by a Singapore-based company in order to attract Singapore buyers and the focus is on activity-based retail. The idea is to leverage the abundance of cheap land in Nusajaya to provide retail elements not found in land-scarce Singapore. There are several key components, including an industrial park, an auto test track and China Mall. Towards the end of last year, these projects started to materialise. In Oct 2012, UEM Land entered into a 40:60 joint venture with Ascendas Land (Malaysia) Sdn Bhd to develop a RM3.7bn 519-acre integrated technology park in Gerbang Nusajaya. The land was sold to the joint venture company at RM13 psf. This project is slated to take off this year and should help attract Singapore businesses to Iskandar.

In Dec 2012, UEM Land entered into a memorandum of understanding with China Mall Holdings Pte Ltd to develop China Mall, a trade and exhibition centre. Also that same month, UEM Land entered into a 30:70 joint venture with FASTrack Autosports Pte Ltd, a company controlled by Singapore billionaire Peter Lim, to develop 270 acres in Gerbang Nusajaya into a RM3.5bn Motorsports City. The land was sold for RM223.5m or RM19 psf. The proposed development will consist of showrooms, automotive retail, workshop, test track, go-kart track and all other automotive-related trades and activities with emphasis on 4S, i.e. sales, service, spare parts and system.

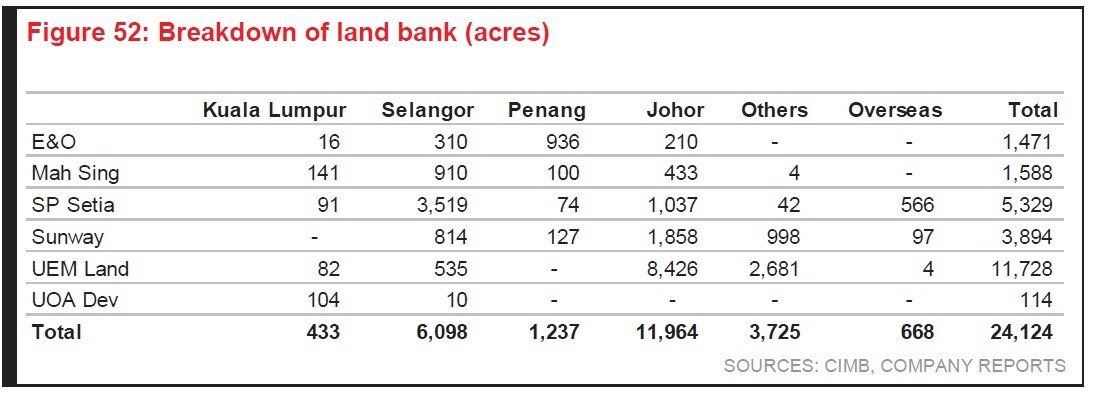

4.4 Other developers under our coverage

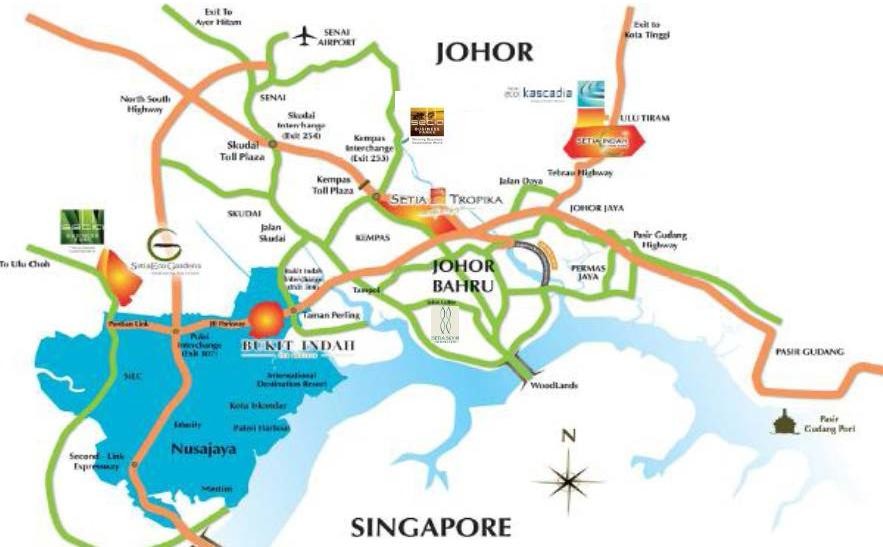

Nearly all developers under our coverage with the exception of UOA Dev have exposure to Johor. Even UOA Dev was eyeing landbank in Iskandar but will only venture there at the right price and right location. In terms of landbank, UEM Land has by far the biggest exposure to Johor at 8,426 acres, of which 7,166 acres is in Nusajaya. A distant second is SP Setia with over 1,000 acres of landbank spread throughout seven projects in the state. Several of its projects are located within Iskandar and the group’s Bukit Indah Johor township is part of Nusajaya. For many years now, SP Setia was the dominant developer in Johor and in FY10/10, the group chalked up a record RM1.35bn in new sales.

SP Setia’s various projects in Johor

Last year, however, UEM Land for the first time took over the lead as the top selling developer in Johor and racked up RM1.8bn in sales. This came mainly from its East Ledang, Horizon Hills and Teega projects. In fact, 73% of its new sales in 2012 came from Nusajaya and only 27% from outside Johor. This shows that demand in Johor, particularly Iskandar, is really taking off. SP Setia is very bullish about Iskandar and president and CEO Tan Sri Liew Kee Sin said during its FY12 analyst briefing that “it is boom town Charlie” for Iskandar over the next five years.

SP Setia’s bullishness is not surprising given the very strong demand for its various products. Last year, SP Setia’s project in Johor Bahru, Setia Sky 88, chalked up a record for Johor Bahru condo prices. The RM750m project achieved average prices of RM900-1,400 psf, unheard of in Johor Bahru at that time. Despite the steep prices, the response to the project was overwhelming and take-up rate is 100%. Many buyers were Singaporeans.

Under our coverage, Mah Sing is a further distant third in terms of sales from Johor in 2012 as new sales from the state was only RM250m. But with its new condo project in Medini, Mah Sing is targeting to achieve RM609m in new sales from Johor in 2013. Mah Sing acquired the 8.2-acre land in Medini in Oct 2012 for RM75m or RM209 psf. The leasehold land has a plot ratio of 6x while GDV is large at RM1.1bn. The project comprises residential properties priced around the RM550-600 psf range, retail and commercial space as well as a hotel. Mah Sing plans to launch the project in 2H13.

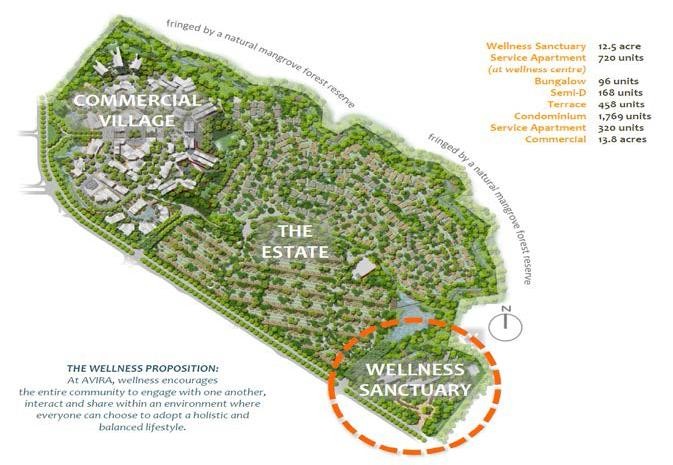

E&O will be the new comer to Johor in 2013 and will soon launch its RM3bn wellness project. The project is a joint venture between E&O, Khazanah and Temasek. The 210 acres was acquired in mid-2011 at a cost of RM350m or RM38 psf, are leasehold (99 years + 30 years) and payments will be made in three tranches. The development does not have any Bumiputera or foreign buyer quotas and come with tax incentives. The township will include a peat reserve with walkways for residents and a water retention pond that will be beautified. Residential properties there will be gated and guarded and E&O’s main target market is Singaporeans.

In Iskandar, Sunway owns three landbanks, which have a total size of 1,858 acres (48% of total landbank). Two plots measuring a combined 1,770 acres are located in 1) Medini South (691 acres) and was purchased in 2011 for RM745.3m, and 2) Pendas Region (1,079 acres), comprising Pendas North and Western Pendas South (779 acres) and Eastern Pendas South (300 acres). The total purchase price was RM597m (RM12 psf). Total GDV for Medini South is RM12bn over 10 years. First launch (RM300-400m GDV) is targeted for end-2012 or early-2013. It will be a mixed development consisting of a hotel, serviced apartments, office lots and retail shops. The Pendas Region land plots have a total GDV of RM18bn over 15-17 years. It will offer a mixed integrated development with a commercial-residential split of 65:35 and could also offer other amenities, such as hospitality, healthcare and education facilities and theme park. First launch is likely a year from now, pending the finalisation of the development’s masterplan. Sunway holds a 60% stake in this venture while the balance 40% is held by Iskandar Asset Sdn Bhd (IASB).

Sunway’s land in Medini and Pendas

6.2 Transport infrastructure to shift to rail work

Highways, the upgrading of major road networks and building of new ones had been completed between 2010 and 2012, mainly awarded to private companies. The main project was the RM945m Coastal Highway. This is a 6-lane, toll-free highway that links Nusajaya and Johor Bahru city (at Danga Bay) and was completed and officially opened to the public in 2Q12. The 15km stretch cuts the existing 30-minute ride to the Johor Bahru city centre to 15 minutes while dispersing traffic congestion by 30%. Over the next 5-6 years, we expect infrastructure construction in Iskandar to shift to its rail transport system.

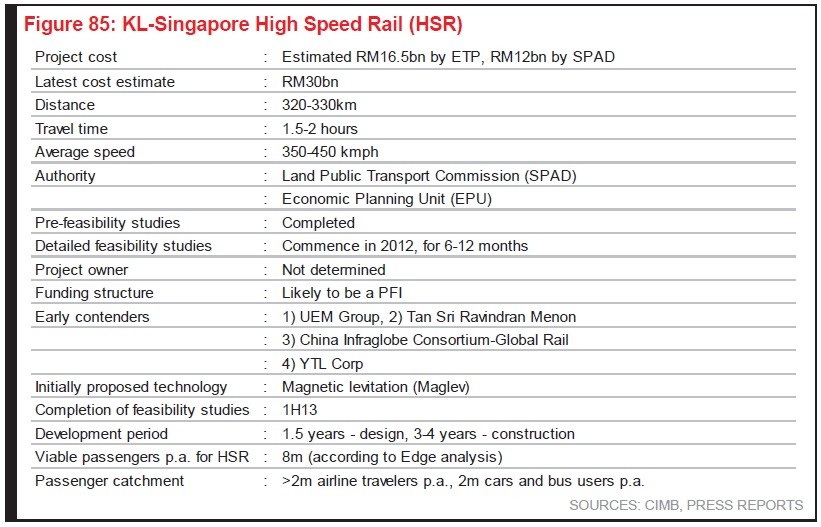

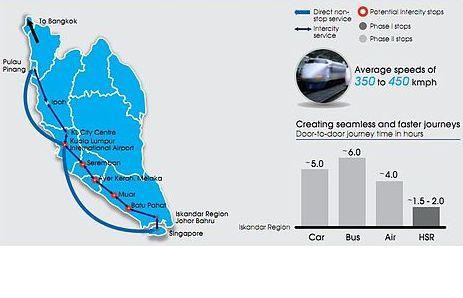

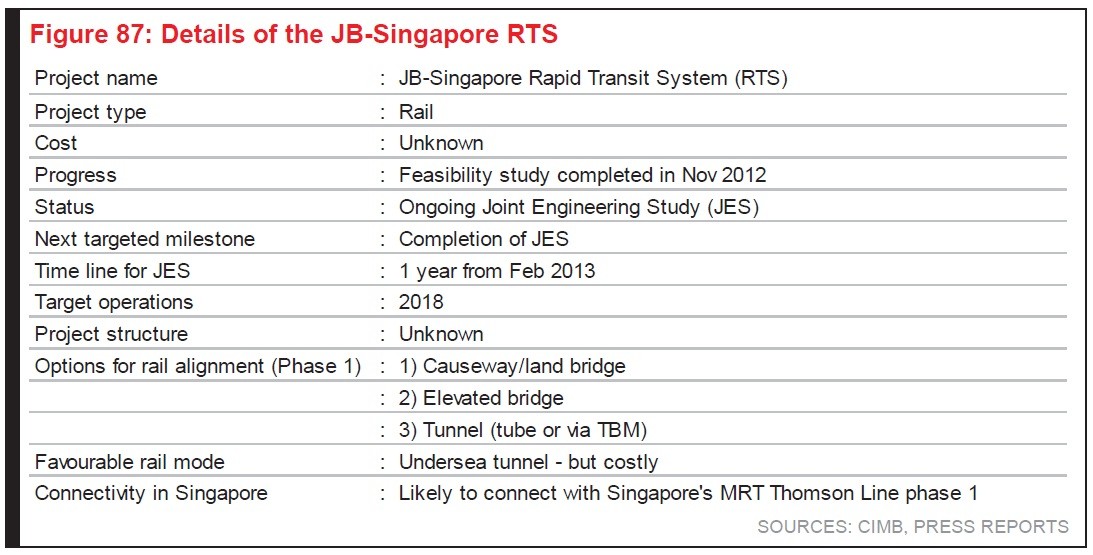

6.3 HSR and RTS

The proposed KL-Singapore High Speed Rail (HSR) and JB-Singapore Rapit Transit System (RTS) should improve rail connectivity in the peninsula’s southern region. This would benefit Iskandar as accessibility to the area from KL and Singapore will be greatly enhanced, a positive for property valuations. However, such plans will only be realised over the longer term as both the HSR and RTS are still in their planning stage, with completion targets of 2018-19, or 5-6 years down the road. Construction will be positive for contractors on a wider scale as tenders are likely to be split into several packages.

6.4 HSR tenders in 2014?

Feasibility studies for the HSR have been completed but the project still needs more detailed evaluation before a possible project structure can be firmed up. Although both the Malaysian and Singapore governments have agreed to pursue it, we understand that plans would take at least another 1.5 years to progress to the detailed design and tender stages. The widely reported RM30bn cost estimate is still questionable, pending a decision on the rail’s final alignments, track profile and number of stops. The alignments (320-330km) will be entirely new and are likely to cover the major part of the western corridor of Peninsular Malaysia.

HSR’s indicative alignments and stops

6.5 RTS under joint feasibility study

Estimated cost for the RTS and its indicative project structure are outstanding as the job is still under a joint-engineering study (JES) by the Malaysian and Singapore governments. The JES began in early 2012 and is scheduled for completion in 12 months’ time. Phase 1 of the initial study will cover possible methods to install the rail alignments between Johor and Singapore. There are currently three options: 1) building a causeway or land bridge; 2) building an elevated bridge; or 3) building an underwater tunnel beneath the Straits of Johor.

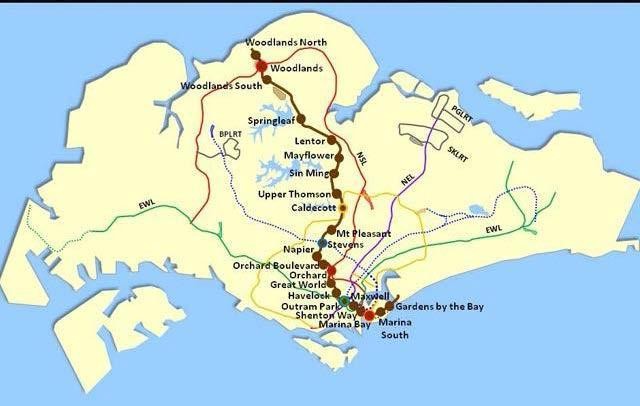

6.6 RTS to link with Thomson Line

Based on the initial plans, the RTS should be operational by 2018, which would coincide with the targeted completion of Singapore MRT’s Thomson Line Phase 1. The Thomson Line is a 30km underground MRT system costing S$18bn. It will cover Singapore’s north-south regions. Phase 1 is located in Woodlands, Singapore’s northernmost point closest to Johor. There are plans to integrate the RTS with the Thomson Line.

Alignment of Singapore’s MRT Thompson Line

6.7 Beneficiaries of HSR and RTS

The construction of HSR and RTS is likely to draw the interest of contractors which have track records and experience in rail jobs. The project structure for RTS is unknown at this point. As for the HSR, given the size of the job, tenders are likely to be broken down into packages, as with the MRT SBK Line. The civil work/viaduct portion of the MRT SBK Line was broken down into eight packages. Of the eight, six were awarded to listed contractors. They included IJM Corp, Ahmad Zaki Resources, Sunway, MTD ACPI, Gadang and Mudajaya. Gamuda, on the other hand, was awarded the 9.5km underground portion, including tunnelling work. We do not discount the possibility that past MRT winners would end up being the beneficiaries of HSR again. Other contractors like WCT which were not successful in their MRT tenders may bid for HSR too. Also, if the RTS is built as an underground tunnel using tunnel-boring technology, Gamuda may stand a chance, given its cost advantage in the MRT SBK Line.

6.8 Contractors with biggest property exposure to Iskandar

Contractors under our coverage also have property exposure to Iskandar. But the ones with larger exposure are WCT, Sunway and Gamuda. WCT has a total of 46 acres (4% of group land bank) of landbank in Johor, of which 34 acres are located in Medini. The three land parcels in Medini has a total outstanding GDV of RM2.8bn, comprising high-rise homes and mixed commercial developments. This accounts for 19% of its total group outstanding GDV. Sunway owns 1,858 acres in Iskandar or 48% of its total landbank. Total estimated GDV is RM30bn over 12-17 years and will feature a township development similar to its integrated development in Bandar Sunway. As for Gamuda, it owns a 50% share of Horizon Hills in Nusajaya with UEM Land. Its total remaining GDV here is RM4.8bn (55% of its domestic GDV) with unsold land of 710 acres or 69% of its total unsold land domestically.

9. SINGAPORE PERSPECTIVE

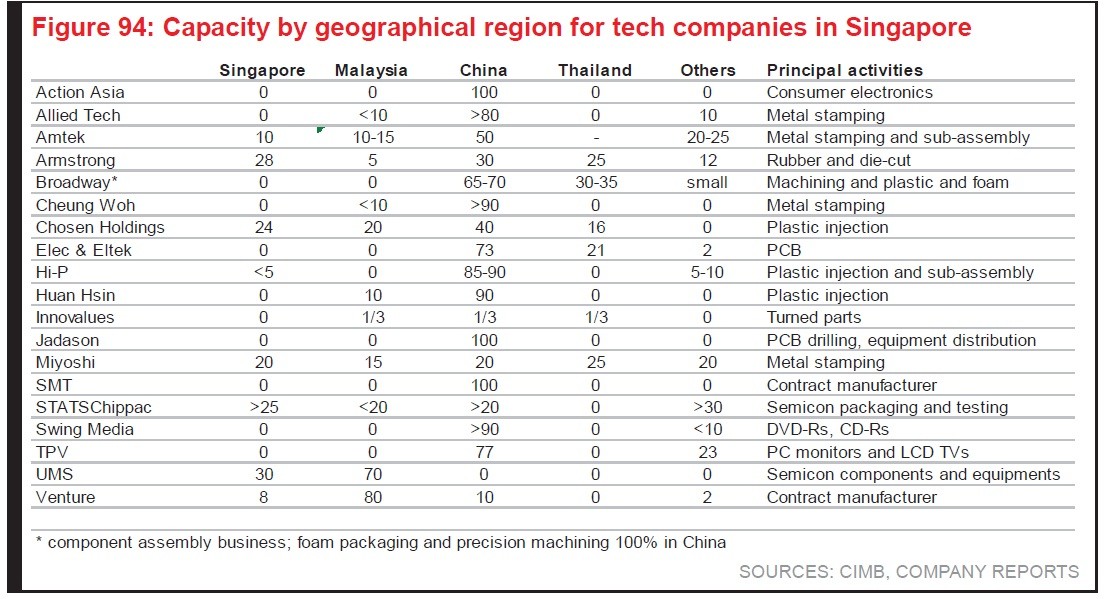

9.1 Why companies are choosing to go there?

Proximity to Singapore and costs are key attractions…

Close proximity and lower operating costs (labour, utilities, rentals, etc.) are the two main attractions that make Johor the “ideal” location to establish operations support facilities for many Singapore companies, especially for small and medium enterprises (SMEs). Moving at least some of their manufacturing and logistics operations across the Causeway would provide SMEs some much needed relief by way of lower costs, while ensuring that the supply chain for their customers remains unbroken. Not surprisingly, Singapore manufacturers have comprised the largest group of foreign investors in Iskandar over the past few years. We believe the trend will continue, especially given the rising costs and tightening of foreign labour supply in Singapore. The Economic Development Board (EDB) has also been encouraging multinational corporations (MNCs) to invest in Iskandar of late, as it expects Iskandar to complement Singapore. The higher-value operations and headquarters will be located in Singapore, while factories and warehouses are expected to operate in neighbouring countries such as Malaysia (or Iskandar to be specific). EDB’s strategy is similar to its partnership with the Indonesian islands of Batam, Bintan and Karimun (BBK). According to the EDB Chairman, EDB is now in preliminary discussions with companies to facilitate “the twinning of manufacturing activities between Singapore and Iskandar Malaysia”. Companies that have shown interest include those from the transport engineering, electronics, precision engineering and energy and chemicals sectors.

…but tech companies have other considerations as well

Almost all Singapore-listed tech companies have already moved their high-volume, labour-intensive production out of Singapore to low-cost countries, such as Malaysia, China, Thailand and Indonesia over the years, while keeping only the high-value added, prototyping and R&D operations in the island state. Most of the companies we spoke to, however, highlighted that their choice of investment location will depend largely on their OEM customers’ requirements rather than the development of Iskandar. Among the tech companies under our coverage, Venture (VMS SP, Outperform) has the largest presence in Johor Bahru and Penang, with about 80% of its capacity in Malaysia (Johor and Penang). Venture said Malaysia will continue to be its main manufacturing hub, and will complement its R&D activities in Singapore. On the other hand, companies that have huge exposure in China, e.g. Hi-P (HIP SP, Underperform) and Huan Hsin (HUAN SP, NR), expressed their lack of intention to set up facilities in Iskandar as most of their OEM/ODM customers are based in China. Some of the other concerns raised by corporates that we spoke to include:

(i) Some of them are also facing tight labour supply in Johor, especially for skilled workers as these workers would rather work in Singapore where wages are much higher; and

(ii) Safety of their workers and investments in Iskandar. While some companies feel that there are no security concerns within the industrial estates, they are not so sure when it comes to the level of safety outside these industrial estates.

59

Iskandar – attracting more attention from Singapore of late

The interest in Iskandar appears to have gathered momentum in the last 12 months, with several major investments announced by Singapore companies. The latest “endorsement” by the Singapore government through the joint development of Afiniti Medini and Avira resort wellness project could further spur interest in Iskandar.

Some of the more prominent projects announced recently:

Feb 13 – Afiniti Medini, an urban wellness project that aims to become a regional destination for families, tourists and professionals, is a joint development by Khazanah Nasional and Temasek Holdings. It features a wellness centre, service apartments, a corporate training centre and retail space. Afinity Medini is expected to be completed by end-2015. Avira – another resort wellness project at Medini Central – will have homes, service apartments and commercial space. The development is expected to be completed in 2018. Besides being among the five flagship zones at Iskandar Malaysia, Medini is also 40 minutes away from the Central Business District in Singapore by car. Both projects will have a total gross development value (GDV) of RM3bn (US$968m).

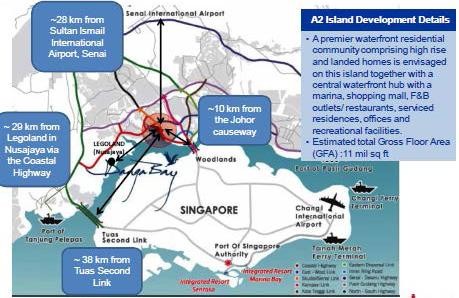

Feb 13 – CapitaLand is leading a joint venture to develop a project in Johor worth about US$2.6bn. The development at Danga Bay will include a waterfront residential community comprising high-rise and landed homes, along with a marina, a shopping mall, offices and recreational facilities. The joint venture will acquire 3.1m sq ft of freehold land for US$261m for the project, which will have an estimated total gross floor area of 11m sq ft. It is expected to be developed in phases over a period of 10 to 12 years. CapitaLand Malaysia will hold 51% of the joint venture, Malaysian company Iskandar Waterfront Sdn Bhd (IWSB) will own 40% and Singapore investment giant Temasek Holdings will take up the remaining 9%

Feb 13 – 5.9ha parcel of land was sold by Global Capital & Development to a private Singaporean developer, Link (THM) Holdings Pte Ltd, for US$31m. This translates into a price of US$48.5 psf, which is comparable to other land transactions within the area. The parcel of land is mooted for a mixed development hub with a GDV of US$804m. The scheme will be called Media Village@ Medini Iskandar and it is located at the entrance of Pinewood Studios – a film and TV production facility. This development will comprise residential and retail properties, and the group plans to turn the retail portion into seven cultural clusters.

Dec 12 – Peter Lim plans to invest up to US$968m more in Johor’s Iskandar region over the next few years. He said he is currently looking at another one or two more projects in the area, but declined to disclose more details. Speaking at the sidelines of a press conference at the World Islamic Economic Forum in Johor Bahru, Mr Lim said his investments would be real estate-related. Thiscould involve acquiring land as well as commercial or residential properties. He said the additional investment is on top of the US$3.2bn Vantage Bay waterfront project, also in Johor Bahru, which he is developing with the Johor royal family. Separately, Mr Lim announced a joint venture to build a US$1.1bn Motorsports City, also in the Iskandar region. This JV is between FASTrack Autosports, a company which he controls together with the Johor royal family, and UEM Land, a subsidiary of Khazanah Nasional Bhd. Last year, Mr Lim also announced plans to develop a US$64m healthcare project at Stulang Laut in Johor Baru.

Oct 12 – Ascendas Land International Pte Ltd, a unit linked to Singapore’s state-JTC Corp, has inked a landmark deal to help build an integrated technology park over 210ha in Gerbang Nusajaya. This development boasts a GDV of US$1.2bn, with an equity split of 60:40 with UEM Land. This development is expected to be fully ready by 2022 and will help create over 34,000 jobs.

Sep 12 – Raffles Education Corporation has inked a deal with Iskandar Investment Bhd to buy a plot of land to set up Raffles American School (RAS), which represents its maiden foray into pre-tertiary education. The company will pay about US$25m for the 18.5ha land in EduCity, which is located in Iskandar Malaysia’s Nusajaya area. The proposed permanent campus, designed by the New York architectural firm Skidmore, Owings & Merrill, will have 300k sq ft of built-up space for 2,000 students. Facilities in the school compound will include an indoor athletics complex, a performing arts centre that houses a black box theatre and a 800-seat traditional performing arts theatre, as well as a library and media centre. Outdoor facilities at the campus comprise two swimming pools, three tennis courts, a soccer field, a basketball court and a 400-metre track. Construction will be done in two phases. Phase one is targeted to be completed in the 2014-15 school year, after which RAS will be able to hold classes for kindergarten through Grade 12, and it will also have full-boarding capacity. RAS offers an American curriculum from kindergarten through to Grade 12, or the equivalent of the second year of junior college in Singapore. Its curriculum is jointly developed with International Schools Services. According to the company’s announcement, the school prepares students for admission to US and Western universities, and is accredited by the Western Association of Schools and Colleges, US. RAS started classes for Grades 1 through 8 last month at a temporary campus in Anjung Neighbourhood Centre in Nusajaya. Besides RAS, Raffles Education Corp had earlier invested US$64m in Raffles University Iskandar in the same EduCity. Launched in Aug 12, the university offers courses in design and art, business, education and infocomm technology. Classes for the university are currently conducted at a temporary location at Menara Kotaraya in Johor Bahru, while a 26.3-hectare campus is being built that is slated for completion in 2014.

9.2 How will transport links improve?

The two main links from Singapore to Johor Bahru currently are the Causeway and Tuas Second Link (opened in 1998). However, a feasibility study is being conducted on the Malaysia-Singapore Rapid Transit System (RTS) link project to further improve the ease of travelling between Singapore and Johor. According to IRDA Chief Executive Officer Datuk Ismail Ibrahim, phase one of the joint-engineering study will focus on the various alignments, customs, immigration and quarantine-related matters, multimodal terminal locations and other critical perimeters.

In May 2012, Malaysia and Singapore announced that both countries will undertake a project to improve connectivity by opening an RTS from Singapore to Johor Bahru by 2018. The joint Singapore-Malaysia statement said that the terminating stations of the link will be built in JB Sentral in Johor Bahru and the vicinity of Republic Polytechnic in Singapore. It added that the RTS link was expected to be up and running by 2018 and will have a co-located facility in Singapore and Johor Bahru so that commuters only need to clear immigration only once for each way of travel.

Separately, during the Singapore-Malaysia leaders’ retreat in Feb 2013, Singapore’s PM Lee Hsien Loong and Malaysia’s PM Dato’ Seri Mohd Najib jointly announced an agreement to build a high-speed rail (HSR) link between Kuala Lumpur and Singapore. This will facilitate seamless travel between Kuala Lumpur and Singapore, as well as further enhance business linkages between the two cities. Completion is slated for 2020 and the estimated travelling time between Kuala Lumpur and Singapore via the HSR is 90 minutes. Malaysia’s Transport Minister Dato’ Seri Kong Cho Ha said that an initial study has identified five towns where new railway stations will be built, including Seremban in Negri Sembilan, Ayer Keroh in Malacca, as well as Muar, Batu Pahat and Iskandar Johor – all located in Johor.

The respective prime ministers also took note of the expected commencement in 2013 of a new ferry terminal and customs, immigration and quarantine facilities in Puteri Harbour. Ferry services will operate between Puteri Harbour and Singapore, subject to the regulators’ evaluation of the services.

A ferry ride from Puteri Harbour to Raffles Marina may only take 15-20 minutes

Other feasibility studies include a third road link between Singapore and Malaysia further down the road.

Although the proposed RTS and HSR could make travelling between Singapore and Johor/Iskandar much more convenient and faster, manufacturers could be impacted negatively as more workers from Southern Malaysia can commute easily to Singapore and work there instead of staying in Johor/Iskandar, which further aggravates the problem of labour shortage in Johor.

9.3 The property factor

Buyer demand rising; why did it take so long?

There are essentially three reasons why property buyers from Singapore have shunned Iskandar in the past. These include: 1) concerns over safety; 2) the lack of infrastructure; and 3) concerns over execution. The lack of visible developments in the area, coupled with the property up-cycle seen in Singapore in 2006-2011, has convinced Singapore property investors to remain largely focussed on the island – until now. The entrance of Khazanah (via UEM Land) in 2005 marked a tangible commitment from the Malaysian government to make Iskandar work. We believe the buy-in from the Malaysian governmentboosted the confidence of Singapore property investors on Iskandar. The much improved bilateral ties between the Singapore and Malaysian governments also helped to a certain extent.

What transpired in the last seven years was a visible improvement in infrastructure development and execution. Local developers have stepped up efforts to build houses. The construction of LegoLand, Puteri Harbour Theme Park and numerous education institutions was also completed recently. This, in turn, should spur more housing developments as plans to build LRT, MRT, tram, monorail and ferry transports are set in motion. We believe the proposal to link the Singapore MRT system with Iskandar by 2018 will be the key potential kicker for more Singaporean demand. While there are no official statistics on the trend of Singapore buyers in Iskandar, our ground checks suggest the proportion has been rising. Horizon Hills, an upmarket landed housing development, has c.45% of its take-up coming from foreigners, of which 80% are Singaporeans.

What can Iskandar offer?

The biggest attraction of Iskandar for Singapore property buyers is price. Singapore property prices are now above their historical highs (up c.45% from 2008) which has prompted the government to introduce stringent measures to curtail investment demand. While average prices at Iskandar have also more than doubled since 2008, current house prices remain 4-8x lower than that of Singapore. This only takes into account entry-level prices in Singapore. On a like-for-like basis, the price differential can be even starker. For example, a prime bungalow of 15k sq ft built-up area will cost around US$18m in Singapore. For that amount, buyers will be able to buy more than 10 equivalent units at Horizon Hills, Iskandar. We believe the rising cost of living and unattractive yields in Singapore are starting to channel some genuine and investment demand offshore.

Given the close proximity of Johor and the expected improvement in connectivity between Johor Bahru and Singapore, Iskandar will be a natural choice for Singapore property buyers. Property buyers tend to invest in regions that they understand. The close proximity as well as cultural and demographic similarities are likely to convince many Singaporeans to deploy their investment capital into Iskandar, in our view. We see an increasing number of Singaporeans now opting to stay in Johor Bahru and commute to Singapore for work.

Singapore property companies starting to bite

We note that there has been a rapid pickup in investment interests from Singapore property companies in Iskandar. Ascendas REIT’s (AREIT) parent, Ascendas Land, has recently set up a 60:40 S$1.5bn joint venture with Malaysia’s UEM Land to develop an integrated eco-friendly tech park in Nusajaya. Prompted by a dearth of attractive acquisition targets and its dominant SME exposure, Mapletree Industrial Trust has also indicated the possibility of following its tenants’ foot-steps to Iskandar when its pure-local mandate expires in Oct 2013. Cache and Cambridge have sounded a similar note, indicating the possibility of emulating the action of certain tenants by expanding into Iskandar.

CapitaLand’s move to acquire a plot of land in Danga Bay is perhaps the most significant recognition of Iskandar’s potential by a Singapore-based player. The largest developer in South East Asia by market capitalisation acquired the piece of land with 11m sq ft of GFA for US$259m, through a 51:40:9 JV with Iskandar Waterfront Sdn Bhd (IWSB) and Temasek Holdings, as announced by CapitaLand on Feb 19. The site is located 30 minutes away from the Tuas Second Link by car. CapitaLand will be the master planner for the mixed development, which is expected to be completed in 10-15 years’ time and has an estimated GDV of RM8.1bn (US$2.6bn). Lim Ming Yan, CapitaLand’s new CEO, said that Malaysia and Singapore’s economies complement each other and believes that it is only natural for more Singapore-based developers (such as CapitaLand) to increase its investment exposure at Iskandar. He is positive on the its long-term prospects and sees demand coming from Johor, other parts of Malaysia, Malaysians working in Singapore and Singaporeans. We understand that there has been an immediate uptick in the asking prices for condominiums in Iskandar after CapitaLand announced its Danga Bay foray.

CapitaLand’s investment in Danga Bay’s A2 island development

Phase 1 of Gerbang Nusajaya, which Ascendas and UEM Land’s Eco-Industrial Township is part of

Lingering pushbacks…

While Iskandar appears to be an attractive proposition for industrial REITs, most players (other than Mapletree Logistics Trust) still have fairly tentative Iskandar plans. Most noted that end-user tenants are apprehensive about en-mass relocation. The key pushbacks for many Singapore-based industrialists include: 1) security concerns; 2) the lack of skilled labour; 3) the lack of an integrated business activity hub to support logistics demand and spur the relocation of businesses; and 4) concerns over efficiency, economic and political stability in Malaysia. To tackle some of these issues, the Malaysian authorities have poured in investments to improve road infrastructure and drainage to enhance Iskandar’s general liveability as well as drawn up a safety and security blueprint to lower crime rates. Some of these initiatives have yielded results. As labour and rental cost pressures in Singapore escalate, there have been reports of more SMEs warming up to the idea of relocating low-margin, labour- orland-intensive operations to Iskandar. Among the S-REITs, MLT is the only one with assets in Iskandar.

Despite rising interest in Iskandar, the Singapore developers that we spoke to harboured reservations. CapitaLand sees strong potential in Iskandar and believes it has the relevant expertise to operate in Malaysia. However, the company said it is still too early to commit on the amount of capital that it will be deploying in Iskandar. The Danga Bay investment is likely to be a test-bed for now, as it makes up less than 1% of its RNAV by our estimates. The Chairman of CityDev, Mr Kwek Leng Beng, is positive about Iskandar’s long-term prospects but noted that it is still in its early days in terms of development. He believes that only around 20% of the real estate area is currently developed and he is also concerned over the maintenance of the properties being built. He has indicated that CityDev is likely to remain on the sidelines for now until the general elections in Malaysia are done and dusted, a view shared by CapitaLand. Mr Stephen Riady, Chairman of OUE, has a more sanguine view on Iskandar. He is positive about the development on a longer-term basis as growth prospects in Singapore become more challenging. Both CityDev and OUE currently do not have exposure in Iskandar.

…but prospects can be mouth-watering if more capital is deployed