Introduction

Time flies so fast! 2018 had passed and for many of us, 2018 turned out to be unforgettable year. For the first time in 61 years, we are having a new ruling party as government with the fallen of Barisan National led by ex-PM, Najib Razak. The new government is led probably by the eldest Prime Minister in the world and not only that, Tun Mahathir Mohammad is second time Prime Minister. Probably a record that will not be broken by any true democractic country. Since then, the new government has opened many can of worms such as 1MDB, country’s debt and liabilities, FGV etc which created ruckus in our economy.

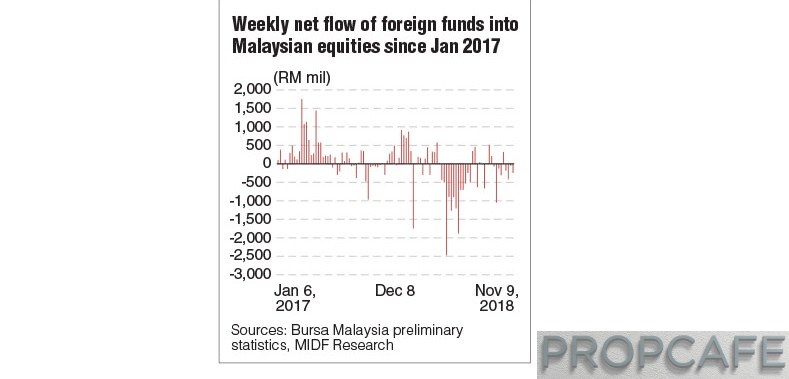

Bursa Malaysia experienced heavy capital outflow of RM1Ob (click the link here) and the KLCI the index has plunged from 1887 prior GE14 and by end of 2018 has closed at 1669, a whopping of 11.5% drop. Many blue chips the price has plunged and wiped RM174b or closed to 10% of whole Bursa Malaysia Market Capitalization (click link here )

The new government is led probably by the eldest Prime Minister in the world and not only that, Tun Mahathir Mohammad is second time Prime Minister. Probably a record that will not be broken by any true democractic country.

Since then, the new government has opened many can of worms such as 1MDB, country’s debt and liabilities, FGV etc which created ruckus in our economy. Bursa Malaysia experienced heavy capital outflow of RM1Ob (click the link here) and the KLCI the index has plunged from 1887 prior GE14 and by end of 2018 has closed at 1669, a whopping of 11.5% drop. Many blue chips the price has plunged and wiped RM174b or closed to 10% of whole Bursa Malaysia Market Capitalization (click link here )

Anyway this is not a political or economy article. However the reality is the politic and economy policies of current government, performance of Bursa Malaysia will have significant impact on the Property Market.

For example, a new government will have different priority such as shelved MRT3 and ECRL and postponement of HSR project. A new government will also have new housing policy.

For property market, a recent published NAPIC report is showing unfavorable supply situation where 3rd QTR 2018 overhang supplies and values was reported increased by 48% and 56% respectively compared to a year ago (Read the link here).

This of course not a great news for most of the stakeholders either government, developers, agents, investors, banks, professional services, contractors and to certain extend even home buyers.

All stakeholders will be affected either one way or another if property market remain in conundrum.

So what should we look forward in 2019? Would we ever seen any positive recovery in 2019?

If there is, what would be theme of the property segment for 2019?

Read on to know PROPCAFE’s view.

Affordable housing

Follow from previous administration, affordable housing is still the main focus and concern of the new government. Home ownership especially among B40 is still low due to high prices and unaffordable among the Malaysians.

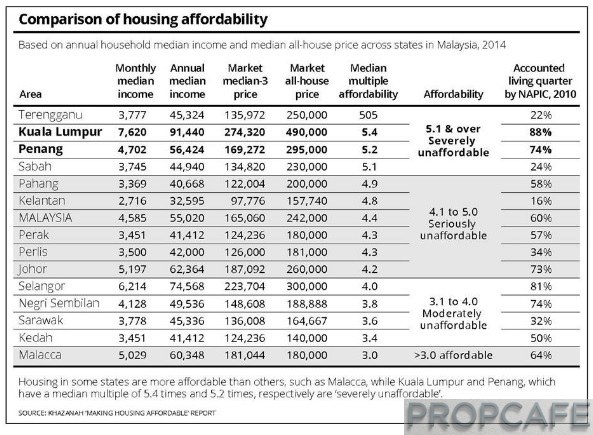

In its 2015 report, Khazanah reported that area like Kuala Lumpur is seriously unaffordable with the median multiple affordability of 5.2 (Read the link here)

In the market now there are few schemes for affordable housing such as Pr1ma, PPA1M, RumahWIP and Rumah SelangorKu. The pricing for such scheme is generally below RM300K which is within the affordability range of median population.

The scheme are general targeted to first time homebuyers due to the stringent criteria such as resale and rent are prohibited within the first 10 years of SPA.

For developers who develop the affordable housing on their land, they are given attractive concession such as favorable plot ratio. Famous developers such as Aset Kayamas with its projects such as The Henge @ Kepong, Parkhill @ Bukit Jalil, The Holmes @ Bandar Tun Razak, Desa Sentral @ Taman Desa etc.

Some developers also jump into the affordability bandwagon however the development without the RumahWIP component. For example, MahSing has launched MCentura in Sentul and MVertical in Cheras and similarly MahSing with its Maxim Majestic in Cheras.

These developments are sharing few similar characteristic. The flat look alike façade, few layouts selection and very high density/plot ratio with basic finishes (no free goods such as kitchen, aircon etc).

The whole idea is to drive the pricing as low as possible and yet the developers are still make decent profit.

For the homebuyers, these developments offer them attractive opportunity to purchase own home where the price is significant lower than market price.

However for investors, these can be double edge sword. No differentiation of units either the layout, façade, view and very high density.

One analogy is buying commodity such as cooking oil, milo, sugar, salt where no differentiation in the market.

Due to nature of the development, buyers/tenants would shopping around to find the best deal. And If no sufficient liquidity/ demand and investors do not have strong holding power, they will throw price to attract buyers and tenants. This is the main risk despite the attractive developer price.

However if you are doing sufficient research (reading and subscribe to PROPCAFE is one of them of course 🙂 ), there are new development that are quite affordable and in the same time good facade looking, variance layout and within good proximity to public transport.

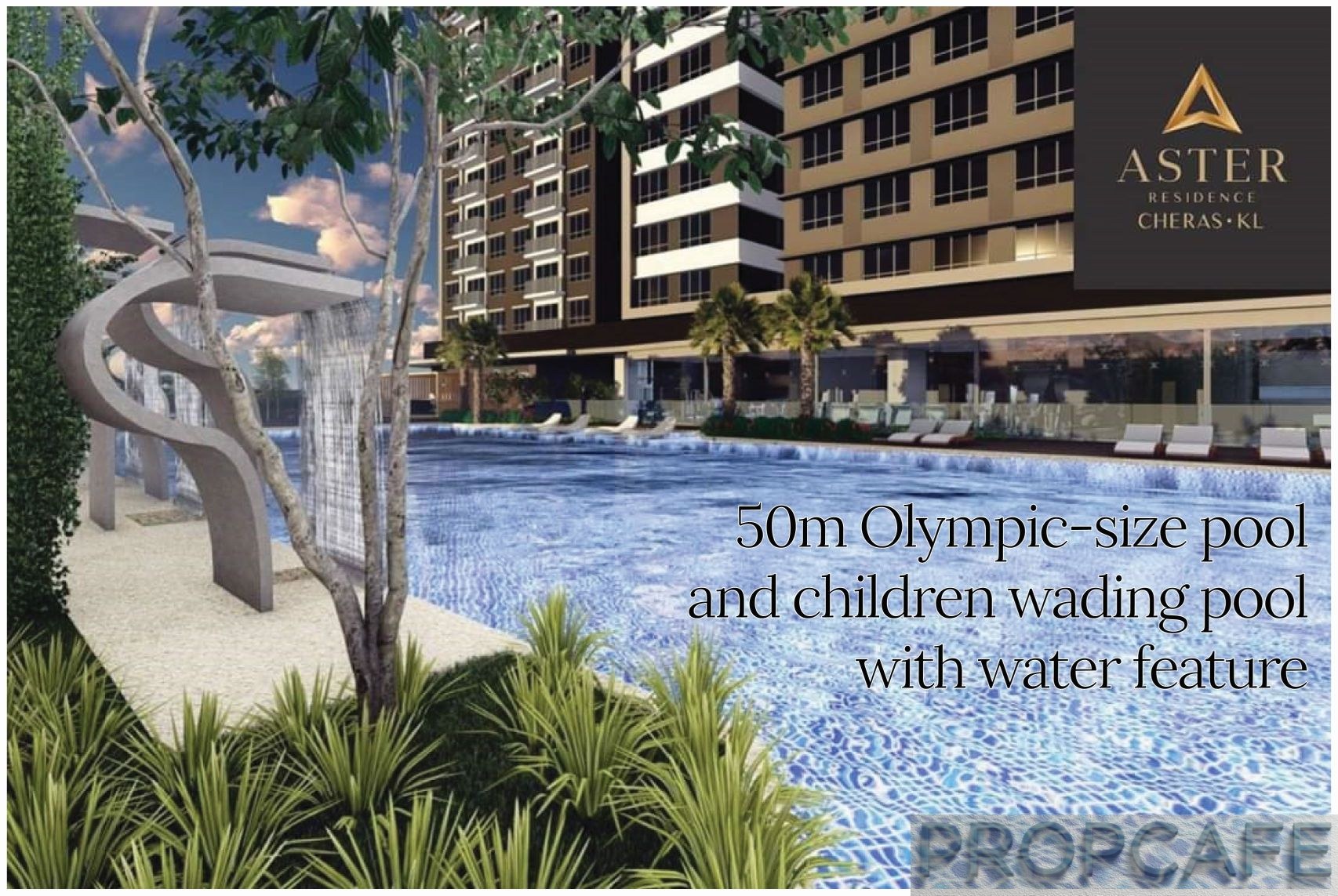

One such project is Aster Residence @ Cheras Hartamas. The facade is clean and glassy and the development comes with impressive facilities such as Olympic size pool, indoor half basketball court, futsal and badminton courts, gym etc.

Not only that, the development comes with multiple and efficient unit layouts to cater from different segment market. The icing on the cake is the development linked with MRT1 Station and priced from RM380k for 2 bedrooms. The monthly installment starts from RM1,600 which is sweet spot for most middle earners and young family.

Readers can read the PROPCAFE review by click PROPCAFE™ Review : Aster Residence Cheras By Amber Homes – Home has a Heartbeat [Part 2]

PROPCAFE™ Review : Aster Residence Cheras By Amber Homes – Home has a Heartbeat [Part 2]

Affordability associated with repayment of loan in the form of monthly installment. Many of home buyers are fixated of finding lowest price to ensure the installment stay within their affordability and ignoring other aspect of purchasing decision.

However bear in mind, income grows inline with the experience, skill and knowledge.

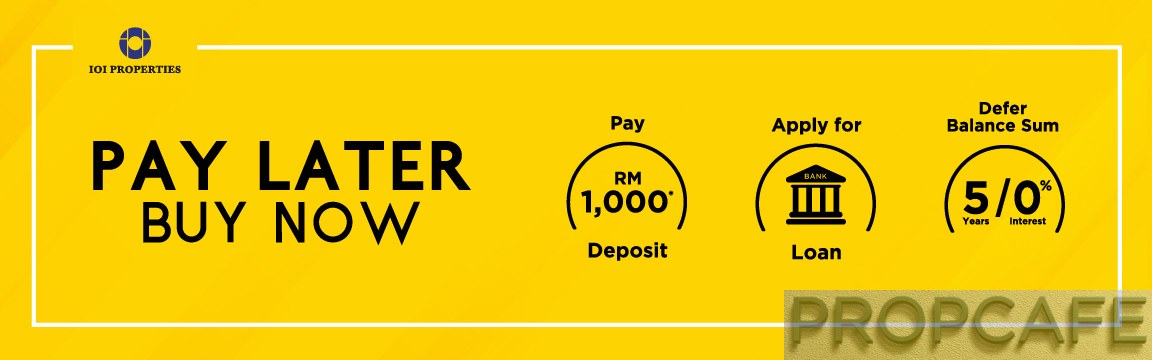

Sometimes, your income will grow exponentially inline with the newly gain skilled. There are many schemes currently in the market offered by developers that allow home buyers to defer the payment to the future.

IOI Properties for example has Pay Later Buy Now scheme where with low downpayment as low as RM1K, homebuyers could immediately move in and settle the deferred payment in 5 years!

Participating projects ranging from Condominium, Townhouse and Semi-D in Puchong, Puchong South, Bangi and Putrajaya.

For more information of IOI’s participating project, click the link Pay Later Buy Now.

Location X 3!

The mantra will never gets old. Location such as Petaling Jaya, Bandar Utama, DPC, Mont Kiara, TTDI, Bangsar, Subang Jaya will remain as favourite either as home and investment.

The scarcity of new supply, demographic of residents, existing amenities and infrastructure remain the main factors why these are remain as evergreen among property hunters.

Obviously the price remain as high concern. For example the newly launched development in PJ Seksyen 13 is priced from RM800psf onwards. In Bangsar, the new launches such as 38Bangsar and Bangsar Hillpark are rumored to be from RM1200psf.

However the truth if buyers are looking for newly launch in this area, there are scarcity due to availability of undeveloped land.

The new launch by Sime Darby Property in Subang Jaya was well received (read the link here) despite it was priced from RM950psf. Apart from its location, developer reputation and product, the project was selling well due to organic demand and almost no new launches in Subang Jaya with exception of Grand Subang in the past 2 years.

The beauty of owning property in these area is the stability, organic growth and demand. The new supply is predictable and usually well absorbed by ready buyers.

Developers are confident to sell out their projects since the new supplies are limited, prospect buyers usually have no choice but to buy from them.

For property owners, it is holding the property and let the power of organic demand and inflation work its magic.

This is evergreen theme and in PROPCAFE’s opinion, this strategy wouldn’t go wrong if you enter the market at the right price.

Public Transport Play

MRT play was one main theme with Najib Razak’s policy to improve the public transport in Klang Valley. As we already known, KL-SG HSR is postponed and operation is targeted to start in 2031 where else the Circle Line (Better known as MRT3) is shelved and government will revisit it again after the completion of MRT2 in 2022.

MRT1 has been completed since 2016 and the ridership is below the target and the maximum capacity of MRT1 which is approximately 400,000 ridership perday. This is understandable and similar to LRT Kelana Jaya line, it needs years for the line to mature.

The maturity is associated with factor such as change of consumer behaviours (such as moving from car ownership to public transport and preference stay in urban rather than rural), completion of existing development (Kwasa, TRX, for example), connectivity and migration of population etc.

PROPCAFE™ Guide: 10 Common Mistakes That Make First Time Property Buyers Stuck!

However gauging the impact of the MRT1 to the development MRT-related, so far it seems pretty muted. Few development which located close to MRT1 stations as D’Sara Sentral @ Sungai Buloh, Ascencia @ TTDI, Q Sentral @ KL Sentral, SwissGarden Residences @ Pudu seems to have stagnant capital appreciation post MRT1 operational.

The only exception PROPCAFE observed was Tropicana Garden @ Kota Damansara where the Arnica appreciates approximately 40% from developer price. However it also remain to be seen whether the subsequent blocks such as Bayberry, Cyperus and Dianthus will have such healthy appreciation upon VP.

For MRT2 and LRT3 after negotiation with government for cost reduction in exchange of reduced scope of work, the project is on course for completion in 2022 and 2025. Many buyers have purchase property within the close proximity of the stations.

Two of the covered projects by PROPCAFE are Rica Residences @ Sentul within 220m away from the station and TR Residences where the entrance is just across the road. Refer to link here and here for the review.

Public transport will increase the traveling mobility and reduce reliance of private mode of transport. From tenancy perspective, MRT/LRT will increase the liquidity to find tenant as well as rental rate due to accessibility and mobility without relying on private mode of transport.

However, the rental yield will depends on the entry price.

Most of the time, developers already include the premium in their development. Aster Residence @ Cheras Hartamas, an affordable MRT linked development which launched recently from RM380K for a 2 bedrooms property are well received by property buyers due to the affordable pricing and 56mtr link bridge to MRT Taman Connaught Station.

Hence, MRT/LRT remain as relevant play however it is not the only factor. There are other factors such as pricing, location, accessibility, demographic to be considered by buyers.

Some of the newly launched project along MRT1 such as Aster, Netizen and ParkLand are sold at very attractive pricing especially its close proximity to the MRT stations. PROPCAFE followers should do proper due diligence before they put their hard earned money in these developments.

Follow the Infrastructure

Highways are the main artery of many new development and for certain townships, they are forking out own capital to build dedicated interchange to existing highway. For example, EcoWorld has built direct interchange from LEKAS. Similarly EcoWorld will improve the access from EcoGrandeur to LATAR highway.

This is the attraction as the highway will cut short the traveling time to main part of Klang Valley. Few of the new highways are under construction now such ask SUKE and DASH. Some shrewd developers have purchase land along these new highways and for existing townships are awaiting for these to be completed (such as Puncak Alam).

Another infra play is big development such as TRX, Bandar Malaysia and PNB118. Many developments are marketed and pitched within the close proximity which will prompt the future catalyst and demand.

Continew (Can read the PROPCAFE review here) for example, was sold within the walking distance to future TRX.

Razak City was sold just across the Bandar Malaysia where the project has been shelved indefinitely due to political sensitivity surrounding 1MDB. Where else for PNB118, the targeted completion is 2024 where Opus will be completed in 2019.

Timing of the property completion is very important. If you buy a property while the infrastructure or the development is still in the infant stage, you need a holding power while waiting for infrastructure to be completed.

Township

Township theme is one of the most relevant and will stay relevant in foreseeable future. The attraction is obvious – township come with single developer who control the supply and mix of launch. Not only that, developer is committed to build the infrastructure and amenities such as school, recreation club, police and fire station, shopping malls, shop etc.

The well planned and newer township will come with security feature such as patrol guard, FnG and GnG within each precinct for the added security. The street is well landscaped and some premium phases will come with immaculate landscaped backlane for the lush resort feeling.

However in Greater Klang Valley context, most of these township rely on the highway as main traveling mode. Township such as Setia Alam / EcoPark / Bukit Raja / Bukit Jelutong / SetiaEcoHill / EcoMajestic rely on highways where nearest public transport is probably 10-15km away.

Hence, the residents would rather drive to the destination rather than detour to nearest public transport. When the township is getting mature, the highways will be choked with traffic. This is experienced by 15 years township like Setia Alam / Bukit Raja where the jam at the toll can be up to 20-30min.

PROPCAFE™ Guide : Townhouse Living Concept

Township is probably one of the favorite spot among homebuyers and investors however for residents, traffic jam in peak hour at the main highways will be constant debate and consideration and for some residents, it is a small price to be paid for the living in a well-planned township.

However PROPCAFE feels that government should invest in enhancing connectivity in these townships however given that our current dire financial situation, mega projects probably a small probability now. However PROPCAFE also feels what buyers should do is invest/buy property with public transport connectivity. Area such as Sepang, Putra Height, Cyberjaya, 16 Sierra and Warisan Puteri – there already and will have stations from ERL/LRT/MRT.

Currently the under construction MRT2 line will traverse through 16 Sierra @ Pouching South by IOI Properties. One station will be built inside 16 Sierra which will provide connectivity to the residents of 16 Sierra @ Pouching South.

To read PROPCAFE review of 16 Sierra @ Puchong South, click the link 16 Sierra, 6 Sierra and Lyden @ 16 Sierra

Development in 16 Sierra such as La Thea, Lyden, Akira, N’ Dira are eligible for IOI’s Pay Later and Buy Now scheme.

Conclusion

There is no right or wrong in every investment and it is depends on your personal criteria, what is your objective, what is your preference and finally risk versus reward of your appetite.

Similar to all property stakeholders, PROPCAFE would glad to see a rebound of property market in 2019 which will bring confidence to all stakeholders.

Till then, have an abundant of joy, wealth and happiness in 2019. Happy Hunting!